Table of Contents

Related Articles

Let's Talk

Sign Up For Free Consultation

What to know before Getting VAT Consultants in Dubai

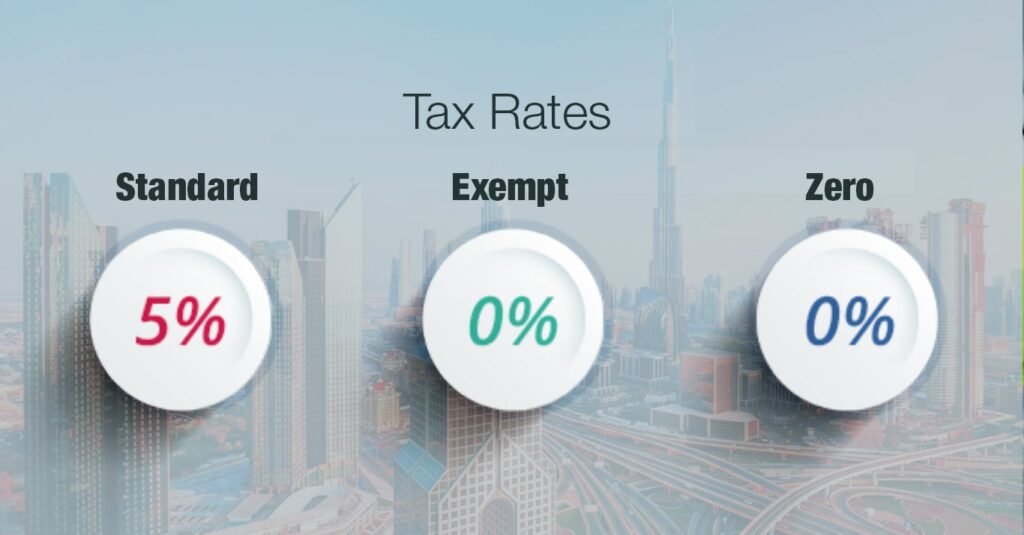

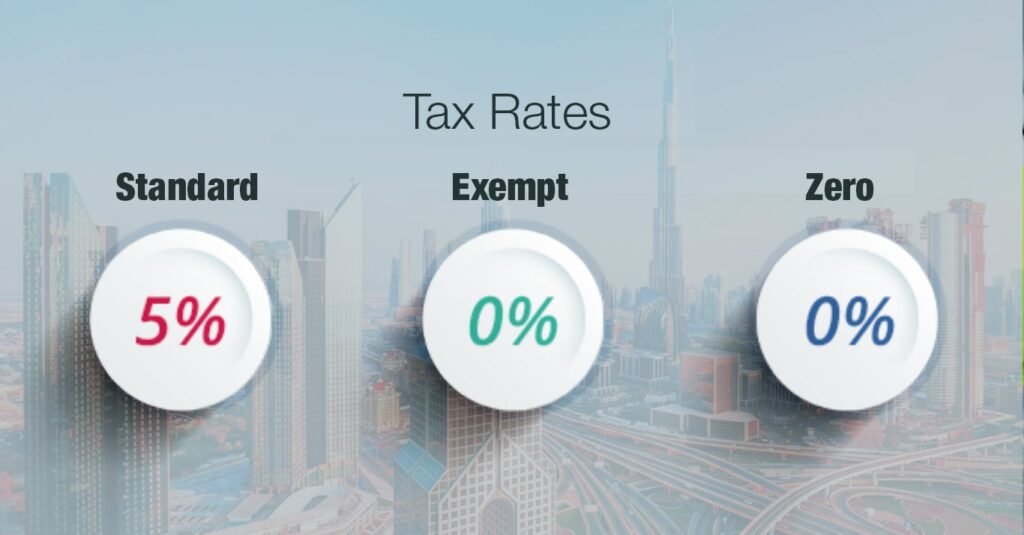

The UAE government, through the Federal Tax Authority (FTA), introduced Value-Added Tax (VAT) on January 1, 2018, at a standard rate of 5%. This indirect tax on the consumption of goods and services is integral to the UAE’s economic structure. For businesses in Dubai, a city known for its dynamic growth, managing VAT can be complex. This is where partnering with a VAT consultancy firm or a Value Added Tax consultant in Dubai becomes crucial. VAT consultants in Dubai help businesses manage everything from VAT registration to VAT compliance services. They ensure that your income, expenses, and VAT charges are accurately documented, helping you navigate the complexities of UAE VAT law. Proper VAT management can minimize risks and streamline operations, especially in compliance-heavy sectors like accounting, audit, and bookkeeping services.

At Tulpar Global Taxation, our team of expert VAT consultants and accountants provide a comprehensive range of services, including VAT advisory services in Dubai, VAT refund assistance, and ensuring compliance with all relevant tax laws. Whether you’re a small business in Dubai or a large company in the UAE, choosing the right VAT advisor can make a significant difference in your business needs. Tulpar Global Taxation specializes in helping businesses adhere to VAT rules and regulations, ensuring that they comply with federal tax requirements, avoid penalties, and take advantage of available VAT refund opportunities. Our services are designed to help companies in Dubai manage their VAT obligations effectively, ensuring smooth compliance with UAE VAT.

In conclusion, whether you’re looking to register for VAT or need ongoing VAT consultancy services, working with the reliable VAT consultants in Dubai is essential. Choose Tulpar Global Taxation to handle your VAT needs, and ensure your business remains compliant and efficient in the fast-paced economy of Dubai.

Who is a VAT Consultant?

A VAT consultant is a specialized tax professional in Value-Added Tax (VAT) regulations and compliance. They assist businesses in navigating the VAT complexities requirements in the United Arab Emirates, ensuring they comply with VAT laws and VAT filing procedures. Businesses in Dubai, especially those required to register for VAT, rely on VAT consultancy services to handle VAT return filing, document VAT charges on sales and purchases, and provide tailored VAT solutions.

VAT consultancy firms in Dubai, like Tulpar Global Taxation, offer comprehensive services that help companies comply with VAT laws, including VAT planning, VAT accounting, and VAT compliance services. These services are essential for minimizing risks and streamlining business operations. Whether you’re a company in Dubai or in any part of the UAE, choosing the right VAT consultants can significantly enhance your financial management.

At Tulpar Global Taxation, we provide VAT consulting and VAT training to ensure smooth and compliant operations. Our services include advising businesses on VAT optimization strategies, handling VAT filing, and ensuring compliance with UAE’s VAT regulations. Our team of chartered accountants and expert VAT consultants are committed to offering the best VAT consultancy services in Dubai. When considering the right VAT consultants in Dubai, it’s important to evaluate the firm’s expertise, the VAT consultancy services offered, and how well they can assist with VAT return filing and other VAT requirements. With VAT advisors also providing ongoing support for potential VAT issues and advice on how VAT is charged, Tulpar Global Taxation ensures your business is well-prepared to handle all aspects of VAT in the UAE.

Overview of VAT Registration in Dubai

VAT registration in the UAE is a critical process for businesses needing to comply with the UAE’s tax regulations. Following the introduction of VAT on January 1, 2018, businesses exceeding a specific annual turnover threshold must register with the Federal Tax Authority (FTA). The standard threshold is AED 375,000, while voluntary VAT registration is available for businesses with annual turnovers exceeding AED 187,500. The VAT registration process involves applying through the FTA’s online portal and submitting essential documents, including the trade license, passport copies, Emirates IDs of the owner(s) or partners, proof of business address, bank account details, and financial statements. VAT consultants in Dubai, such as Tulpar Global Taxation, provide efficient VAT consultancy services tailored to meet these requirements, making the process smoother for businesses.

Once registered and assigned a Tax Registration Number (TRN), businesses must charge VAT at the rate of 5% on taxable supplies, file regular VAT returns, and maintain detailed transaction records to ensure compliance. Businesses needing VAT consultancy services in the UAE often turn to expert VAT consultants to assist with understanding Dubai’s VAT structure and handling the entire VAT process efficiently. Working with experienced VAT service providers helps businesses avoid VAT penalties and ensures that they maintain their credibility.

Tulpar Global Taxation offers specialized VAT advisory in Dubai to help businesses navigate the complexities of VAT assessment, understand how VAT applies to their supply chain, and comply with all federal tax authorities requirements. As VAT advisors with extensive experience in the industry, we guide businesses in selecting the right VAT solutions and ensure compliance on behalf of the government. For businesses that need VAT registration or VAT consultant services, partnering with Tulpar Global Taxation guarantees a streamlined approach, helping to avoid penalties and ensuring smooth business operations.

Benefits of Using VAT Consultancy Services in Dubai

- Using VAT consultancy services in Dubai offers a wide range of benefits for businesses navigating the complexities of VAT rules. By working with the best VAT consultants in Dubai, like Tulpar Global Taxation, businesses can access expert guidance and solutions tailored to their needs. Here’s how VAT advisory can help:

- Expert Guidance on VAT Registration: A VAT registration consultant provides expert assistance during the tax registration process, ensuring businesses meet all legal requirements, gather the necessary documentation, and avoid costly penalties. VAT experts simplify the process of gathering paperwork and filing with the Federal Tax Authority (FTA), streamlining the overall registration process and ensuring that businesses stay compliant.

- Accurate Documentation and Bookkeeping: VAT tax consultants assist in maintaining accurate and organized records of income, expenses, and VAT charges on goods or services. This meticulous documentation is essential for ensuring compliance during VAT audits and for the proper filing of VAT return forms. By partnering with VAT consulting companies in Dubai, businesses can ensure that their financial records are audit-ready and fully transparent.

- Streamlined VAT Return Filing Services: Handling VAT return filing services can be both complex and time-consuming. VAT tax advisors like Tulpar Global Taxation manage this process with efficiency, minimizing the risk of errors in filings. Filing VAT returns accurately and on time is critical to avoiding penalties, and VAT experts ensure that businesses meet these deadlines without fail.

- Tax Optimization and Planning: VAT consultants in the UAE identify potential tax-saving opportunities. Through their deep understanding of VAT laws, they help businesses minimize tax liabilities and enhance overall profitability. Tax planning is a crucial part of this process, allowing businesses to benefit from tax optimization strategies while staying compliant.

- Ongoing Compliance Support and Updates: VAT rules can change frequently, and keeping up with the latest developments is critical for avoiding fines. VAT advisory services in Dubai provide ongoing support and keep businesses updated on changes in VAT rules. Leading VAT consultants ensure businesses remain compliant with the most current laws, reducing the risks associated with non-compliance.

- VAT Training and Capacity Building: Businesses can benefit from VAT training provided by VAT consultants, ensuring that staff are well-versed in VAT procedures and compliance. VAT tax consultants offer practical training sessions to help businesses develop in-house expertise, enabling them to handle VAT matters with greater confidence and efficiency.

- Risk Mitigation: By working with VAT advisors, businesses reduce the risks associated with VAT compliance, such as fines, penalties, or reputational damage. VAT agents in Dubai ensure that all VAT-related activities are conducted accurately, following UAE VAT law, and provide businesses with the peace of mind that comes with knowing they are compliant.

- Enhanced Business Credibility: Utilizing VAT consultancy services signals a business’s commitment to compliance and best practices, which in turn enhances credibility and trust with stakeholders, investors, and regulatory bodies. Tulpar Global Taxation offers tax agent services that help businesses demonstrate their adherence to federal tax authority guidelines, bolstering their reputation.

- Tailored VAT Solutions for Every Business: Every business is unique, and VAT consultants offer customized solutions that align with the specific needs of the business. Whether it’s a growing SME or a large corporation, Tulpar Global Taxation delivers VAT strategies that fit the business’s financial structure, industry, and long-term goals.

- Focus on Core Business Activities: By outsourcing VAT-related tasks to professionals, businesses can focus on their core business activities. Carney VAT Consulting and other VAT consulting services in Dubai help free up valuable time for business owners, allowing them to concentrate on growth and success while ensuring all tax matters are in capable hands.

At Tulpar Global Taxation, we offer top-tier VAT advisory services in Dubai, combining our expertise in VAT registration, tax return filings, and VAT compliance with industry-leading service. Whether you are looking for the best VAT consultant in UAE or simply need expert advice on VAT compliance, we are here to help.

What Key Services Do Professional VAT Consultancy Services Offer in Dubai

Professional VAT consultancy services in Dubai offer a comprehensive range of key services to help businesses manage their VAT obligations effectively. Here are the primary services they provide:

- VAT Registration and Deregistration: VAT consultants assist businesses with the entire registration process, ensuring compliance with the UAE’s VAT laws. They also handle deregistration procedures when businesses no longer meet the VAT registration requirements or cease operations.

- VAT Compliance and Reporting: Ensuring that businesses comply with all VAT rules, consultants manage the accurate preparation and timely submission of VAT returns. This includes calculating VAT liabilities, claiming input VAT credits, and ensuring all necessary documentation is in order.

- VAT Advisory and Planning: Consultants provide strategic advice on VAT planning to optimize tax efficiency. They help businesses understand the impact of VAT on their operations and develop tailored strategies to minimize tax liabilities and maximize savings.

- VAT Audit and Assessment Support: During VAT audits or assessments by the Federal Tax Authority (FTA), VAT consultants offer support by representing businesses, preparing necessary documents, and addressing any queries or discrepancies raised by the authorities.

- VAT Training and Workshops: To ensure businesses and their employees are well-versed in VAT regulations and compliance requirements, consultants conduct training sessions and workshops. These programs cover various aspects of VAT, including filing returns, maintaining records, and understanding VAT laws.

- VAT Refund Management: Consultants assist businesses in claiming VAT refunds where applicable, ensuring that the refund process is handled efficiently and accurately, thereby improving cash flow.

- VAT Health Checks and Reviews: Periodic reviews and health checks of a business’s VAT processes and records are conducted to ensure ongoing compliance. Consultants identify any potential issues and recommend corrective actions to prevent future non-compliance.

- Industry-Specific VAT Solutions: Different industries have unique VAT requirements and challenges. VAT advisors provide industry-specific solutions tailored to the needs of businesses in sectors such as real estate, hospitality, retail, and manufacturing.

- Customs and International Trade Compliance: For businesses involved in import and export activities, VAT consultants offer guidance on customs duties and international trade compliance. This includes advising on the VAT implications of cross-border transactions and ensuring compliance with relevant regulations.

- Dispute Resolution and Appeals: In case of disputes or disagreements with the FTA, VAT consultants represent businesses in resolving issues. They prepare and submit appeals, negotiate settlements, and provide legal support to ensure a favorable outcome.

These key services provided by professional VAT consultancy firms in Dubai help businesses navigate the complexities of VAT regulations, ensuring compliance, optimizing tax efficiency, and minimizing risks.

What Makes a Good VAT Consultancy Service

A good VAT consultancy service excels through a combination of several key factors that ensure effective management of VAT obligations and optimization of tax performance. Here’s what makes a VAT consultancy service stand out:

-

Expert Knowledge of VAT Laws:

An effective VAT consultancy has a thorough understanding of both local and international VAT regulations. This expertise ensures that clients receive precise and compliant advice tailored to their specific tax obligations and industry requirements. With the knowledge that VAT was introduced to enhance tax structures, the consultancy helps businesses comply with the VAT regulations in the UAE. -

Proactive Approach:

A good VAT consultancy anticipates potential issues and opportunities before they arise. By providing strategic guidance and preventive measures, they help businesses handle VAT effectively and avoid common pitfalls, optimizing their VAT management. This proactive stance is crucial for businesses to be ready for VAT audits. -

Customized Solutions:

Tailoring VAT strategies to the unique needs of each client is essential. One of the top VAT consultancy services offers personalized advice and solutions that align with the client’s specific operational and financial context, rather than applying a one-size-fits-all approach. This includes strategies for managing output VAT and ensuring proper documentation for the supply of goods or services. -

Timely and Accurate Compliance:

Ensuring that VAT returns and other compliance-related documents are submitted accurately and on time is crucial. An effective consultancy emphasizes precision and punctuality to prevent penalties and legal complications, thereby maintaining smooth operations for the client. This includes assisting clients with filing the VAT correctly and on schedule. -

Effective Audit Representation:

During VAT audits, strong representation is vital. A reputable consultancy like Tulpar Global Taxation Services provides robust support to protect the client’s interests. They manage the audit process efficiently and address any issues that may arise to ensure a favorable outcome. Their experience and trusted VAT expertise make them a leader among leading VAT consultants in Dubai.

Overall, VAT consultancy has become an essential service for businesses navigating the complexities of tax in the UAE. With the structured implementation of VAT strategies, businesses can enhance their financial performance and ensure compliance with regulatory standards.

Tulpar Global Taxation For VAT Consultancy in Dubai

Tulpar Global Taxation is recognized as one of the top VAT consultancy services in Dubai, renowned for its expertise in taxation, accounting, and auditing services. As a certified tax agent in the UAE by the Federal Tax Authority (FTA), Tulpar Global Taxation is a trusted partner for businesses navigating the complexities of VAT compliance in the UAE. Our team of VAT consultants offers tailored solutions for managing VAT obligations, from assisting with the VAT registration process to helping businesses file VAT returns on time. We ensure that all necessary documents required for VAT compliance are prepared efficiently, making the process seamless for our clients. Whether you need assistance with input VAT, applying for VAT registration, or understanding VAT laws and regulations, Tulpar Global Taxation is ready to guide you through every step.

With top VAT consultants in Dubai, we ensure businesses are always ready for VAT submission and are equipped to handle all file your VAT needs, including VAT return form 201. Our VAT advisors in Dubai help businesses understand the intricacies of UAE tax laws, allowing them to optimize their financial operations while staying compliant. Our VAT consultancy services are comprehensive, covering everything from compliance services to offering strategic advice on the best ways to pay VAT and stay ahead of regulatory changes. With a reputation for accuracy and reliability, Tulpar Global Taxation supports clients in managing their VAT obligations effectively, ensuring they stay compliant and financially optimized.

For businesses looking to partner with one of the top VAT consultants in Dubai, Tulpar Global Taxation is the ideal choice. Whether you need help with applying for VAT registration, understanding the VAT process, or managing your VAT return filings, we are here to provide expert support.

Tulpar Global Taxation VAT Services

Tulpar Global Taxation provides an extensive suite of VAT-related services designed to address various business needs, ensuring that companies registered under the VAT regime in the UAE remain compliant and financially optimized. As one of the leading VAT consultancies in Dubai, we offer specialized support across all aspects of VAT management.

-

VAT Registration:

With some of the best VAT consultants in the UAE, Tulpar Global Taxation assists businesses in navigating the VAT registration and VAT filing processes. We help you with VAT registration by guiding companies through the necessary documentation, ensuring compliance with UAE VAT regulations from the start, and establishing their VAT status effectively. -

Quarterly VAT Return Submission:

Our experts handle the filing of VAT returns quarterly, ensuring businesses meet their tax obligations accurately and on time. By preparing and filing VAT returns on time, we help companies avoid penalties and ensure their financial performance is optimized. We take charge of the VAT return form submission, making sure every detail is covered. -

Voluntary Disclosure:

At Tulpar, we support clients in correcting any errors or omissions in their VAT filings through the voluntary disclosure process. This allows businesses to address mistakes proactively before they attract penalties, maintaining transparency and compliance per the UAE VAT laws. -

Penalty Reconsideration:

Should a business face VAT-related penalties, Tulpar offers expert assistance in appealing these fines. We navigate the complex penalty reconsideration process, working to potentially reduce or eliminate penalties, safeguarding the client’s interests. -

VAT Refund Submission:

For businesses eligible for VAT refunds, we manage the entire refund process. Our services include preparing and submitting the necessary documentation to claim refunds efficiently, ensuring that our clients receive the funds they are entitled to promptly and in full. -

FTA Audit Representation:

In the event of an FTA audit, Tulpar Global Taxation provides expert representation. We protect our clients’ interests during audits, ensuring the process is handled smoothly and addressing any issues that may arise. Our representation is designed to minimize disruptions and ensure compliance during the audit. -

VAT Consultancy:

Tulpar offers top-tier VAT consultancy services that provide strategic advice on VAT-related matters. Whether it’s planning VAT strategies or ensuring full compliance with UAE regulations, we offer services for all your business needs. Our consultancy helps optimize financial performance and ensures companies are always ready for VAT-related challenges.

Tulpar Global Taxation is one of the best VAT consultancies in Dubai, committed to helping businesses file their VAT returns accurately and efficiently. As top VAT consultants in the UAE, we ensure that our clients comply with the structured framework of VAT or Value Added Tax, providing them with the expertise they need to thrive.

Why Choose Tulpar Global Taxation as a VAT Consultant in Dubai

Choosing Tulpar Global Taxation as your VAT consultant offers you the following benefits:

Several major accounting software platforms can help manage various accounting functions, from recording transactions to generating financial reports. Here are some notable ones:

1. Expertise in UAE Tax Laws:

Our team comprises seasoned professionals with in-depth knowledge of UAE tax regulations. This expertise ensures that clients receive accurate and compliant advice tailored to their specific needs.

2. Multilingual and Diverse Team:

Our diverse team can effectively communicate with clients from various backgrounds, offering personalized services that bridge any communication gaps and address individual client needs.

3. Customized Solutions:

We are committed to providing bespoke VAT solutions. Our approach involves understanding each client’s unique requirements and crafting tailored strategies that support their financial objectives.

4. Comprehensive Services:

Beyond VAT consultancy, Tulpar offers a broad range of related services, including accounting, auditing, and compliance. This comprehensive service offering positions Tulpar as a one-stop solution for all financial and tax-related needs.

Contact Us:

- Website: www.tulpartax.com

- Email: info@tulpartax.com

- Phone: +971-54 444 5124