Share

Table of Contents

Filing VAT returns is mandatory for everyone registered for VAT in the UAE, regardless of their sales, purchases, or type of VAT registration. Through the Federal Tax Authority (FTA) website, individuals and businesses must file VAT returns and access various other VAT services.

The VAT return form, known as “VAT 201,” requires taxpayers to manually input values for Sales, Purchases, Output VAT, Input VAT, and other relevant details into the appropriate sections on the FTA portal. While this process can be tedious and overwhelming, ensuring compliance and avoiding issues with the Federal Tax Authority (FTA) is crucial. Here are 15 essential tips to consider when submitting your VAT returns.

What is VAT Return?

A VAT return is a document that VAT-registered businesses must submit to their tax authority, detailing the amount of Value Added Tax (VAT) they have charged on sales (output tax) and the amount of VAT they have paid on purchases (input tax) during a specific period. The VAT return is used to calculate the net VAT payable or reclaimable for that period.

If the output tax exceeds the input tax, the business must pay the difference to the tax authority. On the other hand, if the input tax exceeds the output tax, the business can claim a refund or carry the excess forward to the next period. In the UAE, VAT returns are submitted through the Federal Tax Authority (FTA) portal using the VAT return form “VAT 201.”

How Does VAT Return Work in the UAE?

In the UAE, the VAT return process requires VAT-registered businesses to diligently maintain comprehensive records of all transactions, including sales, purchases, and the corresponding VAT amounts collected and paid. Each tax period, businesses must calculate the total VAT collected from customers (output tax) and the total VAT paid on purchases and expenses (input tax).

Using these calculations, they complete the VAT return form “VAT 201,” which is submitted through the Federal Tax Authority (FTA) portal. This form requires detailed entries for sales, purchases, output VAT, and input VAT.

After completing the form, businesses review all entries for accuracy before filing the return electronically. If the output VAT exceeds the input VAT, the business must pay the difference to the FTA. On the other hand, if the input VAT exceeds the output VAT, the business can either request a refund or carry the excess forward to the next tax period.

Timely and accurate filing is essential to avoid penalties and fines. The FTA mandates strict compliance and may conduct audits to verify the accuracy of VAT returns. Therefore, businesses must ensure all records are precise and complete, maintaining transparency and adherence to regulations. This process helps maintain the integrity of the tax system and supports businesses in fulfilling their VAT obligations efficiently.

15 Essential Things To Know Before Filing Your VAT Returns in the UAE

Filing VAT returns in the UAE can be a complex and meticulous process, but understanding the key aspects can simplify it and ensure compliance with the Federal Tax Authority (FTA). Here are 15 essential things to know before filing your VAT returns:

1. What are the Three Categories of VAT?

In the UAE, VAT is classified into three main categories: standard-rated, zero-rated, and exempt.

Standard-rated VAT: This applies to most goods and services at a rate of 5%. Businesses must charge this VAT on their sales and can reclaim VAT on their purchases.

Zero-rated VAT: Certain goods and services, such as exports of goods and services outside the GCC, international transportation, and the first sale of residential property, are taxed at 0%. Although businesses must report zero-rated supplies in their VAT returns, they can reclaim the input VAT incurred on related expenses.

Exempt VAT: Some supplies are exempt from VAT, meaning no VAT is charged, and businesses cannot reclaim the VAT on purchases related to these supplies. Examples include specific financial services, residential real estate (except the first supply within three years of completion), and local passenger transport.

2. Who must File a VAT Return in UAE?

In the UAE, any business or individual registered for VAT must file a VAT return. This includes those who exceed the mandatory registration threshold of AED 375,000 in annual taxable supplies and imports, as well as those who have opted for voluntary registration with annual taxable supplies and imports exceeding AED 187,500. Even if no VAT is due for a specific VAT return period, registered entities must still file a nil return to stay compliant.

3. The Importance of Accurate and Timely VAT Filing

In the UAE, any business or individual registered for VAT must file a VAT return. This includes those who exceed the mandatory registration threshold of AED 375,000 in annual taxable supplies and imports, as well as those who have opted for voluntary registration with annual taxable supplies and imports exceeding AED 187,500. Even if no VAT is due for a specific VAT return period, registered entities must still file a nil return to stay compliant.

3. The Importance of Accurate and Timely VAT Filing

Accurate and timely VAT return filing is essential for several reasons. Firstly, it ensures compliance with the Federal Tax Authority (FTA) regulations, helping businesses avoid penalties and fines that can arise from late or incorrect filings. Timely filing also helps maintain good standing with tax authorities, which can be beneficial in case of audits or queries.

Accurate VAT returns ensure that businesses only pay what they owe or reclaim what they are entitled to, which aids in effective cash flow management. Furthermore, accurate VAT reporting contributes to accurate financial records, essential for business planning, securing financing, and overall financial health.

4. VAT Return vs. VAT Refunds: What's the Difference?

VAT Return: This is a periodic report submitted by VAT-registered businesses detailing the VAT collected on sales (output VAT) and the VAT paid on purchases (input VAT). The return calculates the net VAT payable to the FTA or refundable from the FTA. It’s a mandatory filing requirement that ensures businesses report their VAT obligations accurately.

VAT Refund: A VAT refund occurs when the input VAT (the VAT paid on business-related purchases and expenses) exceeds the output VAT (the VAT collected on sales). In this case, businesses can request the excess amount as a refund from the FTA or choose to carry it forward to offset future VAT liabilities. Refunds help maintain business cash flow and ensure that businesses are not out of pocket for VAT paid.

5. When to File VAT Return in UAE?

The UAE VAT return filing is typically done quarterly or monthly, depending on the size and annual turnover of the business. For most businesses, the standard tax period for the payable tax is quarterly. However, businesses with annual turnovers exceeding AED 150 million are required to file monthly returns.

The specific filing period is determined by the FTA at the time of VAT registration and must be adhered to ensure compliance and avoid penalties for late filing.

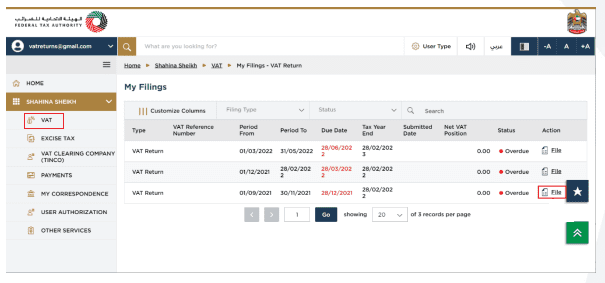

6. How to File a VAT Return in UAE?

To file a VAT return in the UAE, businesses must follow these steps:

Log in to the FTA Portal: Access the Federal Tax Authority’s online portal using your registered credentials.

Navigate to the VAT Returns Section: Locate the section dedicated to VAT returns.

Complete the VAT 201 Form: Enter all required details, including sales, purchases, output VAT, and input VAT. Ensure all values are accurate and supported by documentation.

Review Entries: Double-check all entries for accuracy to avoid mistakes that could lead to penalties or audits.

Submit the Return: Once satisfied with the entries, submit the VAT return electronically through the portal.

Make Payment: If the return shows a net VAT payable, arrange for the payment to be made to the FTA. This can be done through various payment methods available on the portal.

Confirmation: After submission, retain a copy of the confirmation for your records.

7. What is the Standard Tax Period For a Taxable Person in the UAE?

The standard tax period for a taxable person in the UAE can be quarterly or monthly, based on the annual turnover of the business. For most businesses, the tax period is quarterly, meaning they must file VAT returns every three months.

Businesses with an annual turnover exceeding AED 150 million must file monthly returns. This distinction helps manage the frequency of reporting and ensures that larger businesses, which typically have higher transaction volumes, report their VAT liabilities more frequently. However, keep in mind that there might be cases where the first tax period can exceed three months.

8. What is the Tax Returns Submission Date?

The tax return submission date is the 28th day following the end of the tax period. For quarterly returns, this means the 28th day after the end of each quarter. For monthly returns, it is the 28th day after the end of each month. If the submission date falls on a weekend or public holiday, the deadline is extended to the next working day. Timely submission is critical to avoid penalties for late filing.

9. VAT Returns on Zero-rated Supplies & Exempt Supplies

Zero-rated Supplies: These are supplies taxed at 0%. Businesses must still report zero-rated supplies in their VAT return to the FTA. While no VAT is charged to the customer, businesses can reclaim input VAT incurred on related purchases and expenses. Examples include exports and certain healthcare and educational services.

Exempt Supplies: These supplies are exempt from VAT, meaning no VAT is charged, and businesses cannot reclaim VAT on purchases related to these supplies. Examples include residential property leases and specific financial services. Exempt supplies must be reported in the VAT return, but they do not affect the VAT payable or reclaimable.

10. What Documents Are Required For Filing a VAT Return?

To file a VAT return, businesses must maintain and provide several documents:

Sales Invoices: Detailed records of all sales transactions, including the VAT charged.

Purchase Invoices: Records of all purchases and expenses, including the VAT paid.

Financial Statements: Comprehensive financial records for the tax period.

Import and Export Documents: Documentation of any import and export activities.

Bank Statements: Supporting evidence for transactions.

Credit and Debit Notes: Records of any adjustments to invoices.

Other Supporting Documentation: Any additional records that support the entries in the VAT return.

11. VAT on Sales and all other Outputs

VAT on sales and other outputs refers to the VAT collected from customers on taxable supplies. This includes standard-rated sales and any other transactions where VAT is charged. Businesses must report the total output VAT in their VAT return. Accurate reporting of output VAT is crucial to determining the net VAT payable or reclaimable.

12. VAT on Expenses and all other Inputs

VAT on expenses and other inputs refers to the VAT paid on business purchases and expenses. This includes VAT paid on goods, services, and other business-related expenditures. Businesses can reclaim this input VAT against the output VAT in their VAT return, reducing the net VAT payable. Accurate tracking and reporting of input VAT are essential to ensure proper VAT recovery.

13. Key Sections of Form VAT 201

Form VAT 201 is the standard VAT return form used in the UAE. Its key sections include:

Taxable Person Details: Information about the business, including the VAT registration number and contact details.

Sales and Output VAT: Details of sales transactions and the VAT collected.

Purchases and Input VAT: Details of purchase transactions and the VAT paid.

Adjustments: Any adjustments to the VAT due, such as corrections from previous periods.

Net VAT: Calculation of the net VAT payable or refundable.

Declaration and Submission: Confirmation of the accuracy of the information provided and submission of the return.

14. Who is Exempt From VAT in the UAE?

Certain entities and supplies are exempt from VAT in the UAE. These exemptions include:

Residential Real Estate: The lease or sale of residential property (except the first sale within three years of completion) is exempt from VAT.

Financial Services: Certain financial services, such as life insurance and financial transactions involving interest, are exempt from VAT.

Local Passenger Transport: Transport services provided within the UAE are exempt from VAT.

Bare Land: The sale of bare land is exempt from VAT.

Specific Healthcare and Educational Services: Certain healthcare and educational services may be exempt from VAT, subject to specific criteria and conditions outlined by the FTA.

15. What is the Reverse Charge Mechanism?

The Reverse Charge Mechanism (RCM) in the UAE shifts the responsibility for reporting VAT from the seller to the buyer. It typically applies to cross-border transactions of goods and services.

Under RCM, the buyer records both the input VAT (as if they purchased the goods or services locally) and the output VAT (as if they sold the goods or services) in their VAT return. This mechanism ensures VAT is accounted for in the UAE, preventing tax evasion and simplifying the VAT process for foreign suppliers.

Bonus: What is the Penalty For Failing to File a VAT Return?

Failing to file a VAT return in the UAE can result in significant penalties. The Federal Tax Authority (FTA) imposes a fixed penalty of AED 1,000 for the first instance of late filing, which increases to AED 2,000 for each subsequent late filing within 24 months.

Additional penalties based on the percentage of unpaid tax can further increase the financial burden. Moreover, the same tax group fines apply individually to each member if VAT compliance issues arise, meaning that penalties can impact all entities within the tax group.

By understanding these essential aspects of VAT returns, businesses in the UAE can ensure compliance with regulations, avoid penalties, and effectively manage their VAT obligations.

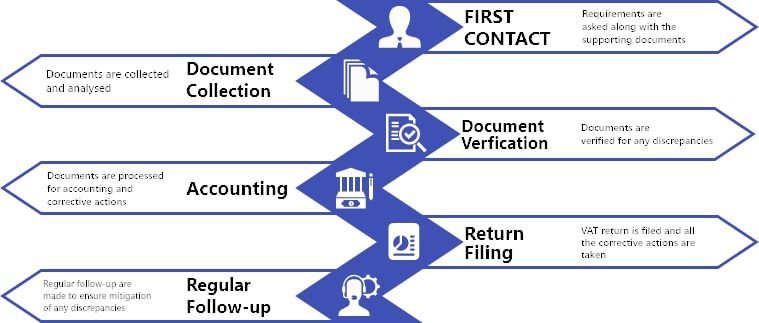

How Can Tulpar Global Taxation Help With Your VAT Filing

Tulpar Global Taxation provides expert assistance with VAT filing to ensure compliance and avoid penalties. Our team helps you accurately prepare and submit VAT returns, manage documentation, and keep abreast of the latest tax regulations. We offer personalized advice tailored to your business needs, minimizing errors and optimizing VAT recovery.

Additionally, Tulpar Global handles all communication with the Federal Tax Authority, reducing your administrative burden. With our comprehensive support, you can focus on your core business activities while ensuring your VAT obligations are met efficiently and on time.