Why Hire Auditors in Dubai?

Table of Contents

Related Articles

Let's Talk

Sign Up For Free Consultation

The United Arab Emirates has established itself as a premier destination for businesses, thanks to its robust and globally advancing economy. With world-class facilities such as the Dubai International Financial Centre, Jebel Ali Free Zone, and Abu Dhabi Global Market, it’s no wonder that companies in Dubai are eager to thrive. However, navigating the complex financial laws and regulations in the UAE can be challenging. This is where Tulpar Global Taxation comes in, providing expert accounting services and comprehensive consultancy services to businesses. Audit services in Dubai are essential for maintaining financial integrity. At Tulpar Global Taxation, our team of skilled auditors in UAE conducts thorough audits to analyze a company’s financial statements and evaluate data to ensure compliancy with local regulations. As one of the leading audit firms in Dubai, we help businesses identify risks and verify financial accuracy, ultimately building investor trust and supporting informed decision-making.

If you’re questioning why your business in Dubai needs a chartered accountant or professional audit support, consider the multiple benefits we offer. Our external audit and internal audit services are designed to manage risks, ensure compliancy, and facilitate the audit procedure effectively. Whether you require a financial audit, forensic audit, or due diligence audit, Tulpar Global Taxation provides the best audit and assurance services in the region.

Additionally, our expertise in VAT, corporate tax, and payroll management ensures that your business remains compliant with the ever-evolving regulations in the UAE. With our comprehensive advisory services and commitment to excellence, we are proud to be recognized among the top audit firms in Dubai. For businesses seeking to establish a presence in the UAE, Tulpar Global Taxation offers company formation assistance, guiding you through the regulatory landscape and ensuring your business is set up for success. As a trusted audit company, we prioritize transparency and accuracy in financial records to help you achieve your business objectives.

With a focus on risk management and compliancy, Tulpar Global Taxation is your partner in navigating the complexities of the financial landscape in Dubai, Sharjah, and beyond. Experience the difference with our expert audit and accounting services, and let us help you elevate your business in the thriving markets of the United Arab Emirates.

What is an Auditing Service?

Tulpar Global Taxation offers audit and accounting services that perform a systematic examination and evaluation of a company’s financial records and statements. Our expert auditors, recognized as some of the top auditors in the industry, are dedicated to ensuring the accuracy and compliancy of financial information with applicable laws, regulations, and accounting standards. Within their legal and professional capacity, our approved auditors in Dubai assess financial bills, identify potential risks, and verify that your company adheres to legal and financial guidelines. This comprehensive auditing process enhances the reliability of financial reporting, supports informed decision-making, and helps build trust with investors and stakeholders.

The outcome of an audit provided by Tulpar Global Taxation is a detailed report that includes the auditor’s opinion on the company’s financial bills and any findings or recommendations for improvement. These audit reports are valuable to stakeholders such as investors, creditors, and regulatory bodies, as they assure the reliability and integrity of the financial information presented by the company. We offer a range of audit and assurance services tailored to meet the needs of businesses based in Dubai and within the free zone jurisdictions in the UAE. As a firm committed to excellence, we also provide tax consulting and tax filing services, ensuring compliancy with value added tax (VAT) regulations and other financial obligations.

Tulpar Global Taxation stands out among firms in the UAE as a leading provider of accounting and tax services. Our approach ensures that our clients receive the highest level of service and expertise, making us a trusted partner in navigating the complexities of jurisdictions in the UAE and almost everywhere else.

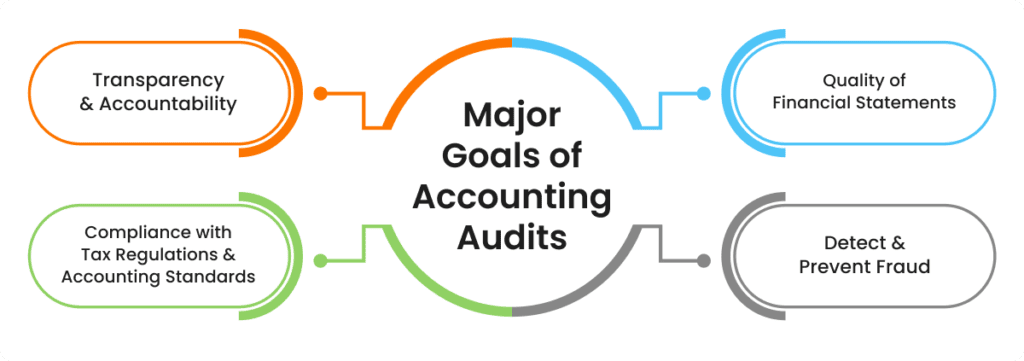

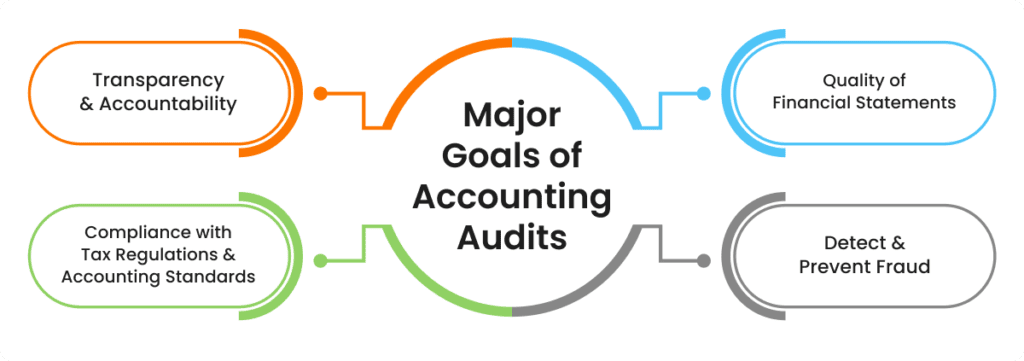

Why Do Businesses Go Through the Auditing Process?

Businesses undergo the auditing process for several important reasons, particularly when working with Tulpar Global Taxation, an audit and advisory firm that offers a range of services in the UAE.

-

Ensuring Accuracy: Qualified and experienced auditors at Tulpar Global Taxation verify the accuracy of financial bills, ensuring that the recorded transactions and balances reflect the true financial position and performance of the company. This helps prevent errors and misstatements.

-

Building Credibility: An independent audit enhances the credibility of financial bills, assuring investors, creditors, and other stakeholders that the information is reliable and trustworthy.

-

Compliance: Audits ensure that the business complies with applicable laws, regulations, and accounting standards, which can help avoid legal penalties and fines. Our approved chartered accountant firm provides the necessary expertise to navigate these complex requirements.

-

Improving Internal Controls: The audit procedure involves evaluating a company’s internal controls and procedures. Identifying weaknesses and areas for improvement can lead to stronger controls and more efficient operations, contributing to overall financial transparency.

-

Detecting and Preventing Fraud: Top-tier audit services can uncover signs of fraud or financial misconduct. Regular audits not only help detect these issues but also serve as a deterrent to fraudulent activities, as employees know that their actions are subject to scrutiny.

-

Enhancing Decision-Making: Reliable financial information provided by an audit helps management make informed decisions. Accurate data is crucial for strategic planning, budgeting, and resource allocation, and it is essential for financial bills prepared by qualified auditors.

-

Meeting Stakeholder Expectations: Stakeholders such as shareholders, investors, and financial institutions often require audited financial bills as a condition for investment, lending, or partnership agreements. Hiring an approved chartered accountant from Tulpar Global Taxation ensures that your business meets these expectations.

-

Facilitating Growth and Expansion: For businesses seeking to grow or expand, audited financial bills can help attract new investors and secure funding, as they provide confidence in the company’s financial health. Tulpar Global Taxation supports this process by offering top-notch accounting and auditing services.

-

Maintaining Transparency: An audit promotes transparency within the organization, fostering trust among employees, management, and external parties. This is particularly crucial in Dubai but also across other regions in the UAE, where firms in the UAE need to establish robust governance and accountability.

By partnering with Tulpar Global Taxation, you can leverage the expertise of qualified and experienced auditors to enhance your business’s credibility, compliancy, and operational efficiency.

Benefits of Using Professional Audit Services

Using pro audit services from Tulpar Global Taxation ensures that businesses maintain high standards of financial integrity, compliancy, and operational excellence across the UAE for sustainable growth and success. Beyond this, they also offer the following benefits:

-

Expertise and Knowledge: Auditing solutions provided by Tulpar Global Taxation bring a wealth of knowledge and expertise in accounting standards, regulations, and industry practices. Their deep understanding ensures thorough and accurate assessments of your financial records.

-

Objective Evaluation: An independent auditor from our auditing firm offers an unbiased and objective evaluation of a company’s financial bills and internal controls, free from any internal pressures or conflicts of interest.

-

Improved Financial Accuracy: Expert audits help ensure the accuracy and reliability of financial records, reducing the risk of errors and misstatements. This accuracy is crucial for making informed business decisions aligned with your business goals.

-

Enhanced Credibility: Audited financial statements from Tulpar Global Taxation add credibility and reliability, which is essential for gaining the trust of investors, creditors, and other stakeholders. This credibility can facilitate access to capital and improve business relationships.

-

Regulatory Compliance: Expert auditors ensure that the company complies with relevant laws, regulations, and accounting standards, helping to avoid legal issues, fines, and penalties through our tax consultancy services.

-

Risk Management: In terms of the industry and business market, auditors can identify potential risks and weaknesses in internal controls and processes. Their recommendations for improvement can help mitigate these risks and enhance overall operational efficiency through comprehensive internal audit services.

-

Fraud Detection and Prevention: Professional audits can uncover signs of fraud or financial misconduct. Regular external audits also act as a deterrent against fraudulent activities, promoting a culture of accountability within the organization.

-

Operational Efficiency: By evaluating internal controls and processes, auditors can identify inefficiencies and suggest improvements, leading to streamlined operations and cost savings through financial advisory services.

-

Stakeholder Confidence: Audited financial statements provide stakeholders with confidence in the company’s financial health and governance, fostering stronger relationships and support, particularly in terms of Corporate Tax compliance.

-

Strategic Planning and Decision-Making: Accurate and reliable financial information from audits aids management in strategic planning, budgeting, and resource allocation, supporting better decision-making as part of our business advisory services.

-

Continuous Improvement: Professional auditors offer insights and best practices that can drive continuous improvement in financial reporting and internal controls, keeping the business aligned with industry standards and innovations.

-

Support for Growth and Expansion: For businesses looking to expand or attract new investors, audited financial statements assure the company’s financial stability, aiding in securing funding and investment opportunities through our audit procedure and statutory audits.

By choosing Tulpar Global Taxation, you gain access to leading audit companies that provide comprehensive auditing and tax advisory services to help your business thrive in the competitive landscape of the UAE.

Key Service Offered By Auditing Services In the UAE

In the UAE, auditing and assurance services offer a range of key services tailored to meet the regulatory and business needs of companies operating in the region. Here are the primary services provided offered by audit firms in the UAE:

1. Financial Statement Audits:

This involves the thorough examination of a company’s financial statements to ensure accuracy, completeness, and compliancy with International Financial Reporting Standards (IFRS) and local regulations.

2. Internal Audits:

Internal audits focus on evaluating and improving the effectiveness of a company’s internal controls, risk control, and governance processes. This helps in identifying operational inefficiencies and areas for improvement.

3. Compliance Audits:

These audits ensure that businesses comply with relevant laws, regulations, and internal policies. This includes compliancy with UAE’s VAT regulations, anti-money laundering (AML) laws, and other statutory requirements.

4. Forensic Audits:

Forensic audits involve investigating financial discrepancies, fraud, or embezzlement. These audits help in uncovering financial misconduct and gathering evidence for legal proceedings if necessary.

5. Operational Audits:

This service evaluates the efficiency and effectiveness of business operations. It aims to improve processes, enhance productivity, and reduce costs by identifying areas where operational improvements can be made.

6. Risk Management and Assessment:

Auditors assess the risks faced by a business and provide recommendations for mitigating these risks. This service helps in establishing robust risk handling frameworks.

7. Special Purpose Audits:

These audits are tailored to meet the specific needs of the business, such as audits of specific accounts, transactions, or compliancy with particular agreements or contracts.

8. VAT and Tax Audits:

These audits ensure that the company’s tax filings and payments are accurate and compliant with UAE VAT and corporate tax laws. Their tax services help in identifying any discrepancies and rectifying them to avoid penalties.

Factors To Consider Before Choosing An Audit Firm in Dubai

Choosing the right audit firm in UAE is crucial for ensuring accurate, reliable, and compliant financial reporting. Here are some key factors to consider before making your decision:

1. Reputation and Experience:

Research the audit firm’s reputation in the industry. Consider their years of experience, especially in your specific sector, and look for client testimonials or case studies that demonstrate their expertise.

2. Qualifications and Expertise:

Internal audits focus on evaluating and improving the effectiveness of a company’s internal controls, risk handling, and governance processes. This helps in identifying operational inefficiencies and areas for improvement.

3. Range of Services:

Evaluate the range of auditing and accounting services offered by the audit company. Beyond financial audits, consider if they provide other relevant services such as accounting, tax consulting, and a wide range of audit services such as internal audits, compliance audits, IT audits, risk control, and forensic audits.

4. Understanding of Local Regulations:

The audit firm should have a thorough understanding of UAE-specific regulations, including VAT laws, anti-money laundering (AML) requirements, and other compliancy mandates.

5. Technology and Tools:

Assess the technology and tools used by the audit company. Modern audit software and data analytics tools can enhance the efficiency and accuracy of the audit process.

6. Industry Specialization:

If your business operates in a specialized industry, consider an audit company with experience and expertise in that sector. Industry-specific knowledge can provide more relevant insights and recommendations.

7. Communication and Responsiveness:

Evaluate the firm’s communication style and responsiveness. Effective communication is essential for a smooth audit process, and the firm should be readily available to address any concerns or queries.

8. Fee Structure:

Understand the fee structure and ensure it aligns with your budget. While cost is important, it should not be the sole determining factor. Consider the value and quality of services provided.

9. Independence and Objectivity:

Ensure that the audit firm maintains independence and objectivity. There should be no conflicts of interest that could compromise the integrity of the audit.

10. Client Portfolio:

Review the firm’s client portfolio to see if they have worked with companies similar to yours in size and industry. This can provide insights into their capability to handle your audit needs.

11. Regulatory Compliance:

Check if the audit firm is registered with relevant regulatory bodies in the UAE, such as the Ministry of Economy or the Dubai Financial Services Authority (DFSA).

12. References and Reviews:

Ask for references from past clients and read reviews to get a sense of the firm’s reliability and performance. Positive feedback from other businesses can be a good indicator of quality service.

By carefully considering these factors, you can select an audit company in Dubai that meets your business needs, ensuring accurate financial reporting, compliancy with regulations, and valuable insights for improvement.

About Tulpar Global Taxation

Tulpar Global Taxation is one of the leading accounting firms in Dubai, renowned for its unwavering commitment to excellence in tax services, auditing services, and comprehensive accounting services. Our extensive service portfolio includes financial health assessments, VAT services, and professional services that cover tax agency support, accurate auditing, and detailed financial analysis. We specialize in preparing financial reports for legal proceedings and conducting thorough tax audits to ensure compliancy with international accounting standards.

Beyond these core offerings, we provide niche advisory services such as feasibility studies, AML (Anti-Money Laundering) compliancy, and efficient debt collection. Our team of highly qualified Chartered Accountants is licensed by the Federal Tax Authority in the UAE, bringing extensive knowledge to the auditing process while adhering to auditing standards and best practices. We serve a diverse clientele, ranging from dynamic startups to high-net-worth international corporations, individuals, and diplomatic entities. With over 15 years of deep experience in UAE tax laws, Tulpar Global Taxation is committed to ensuring compliancy, transparency, and optimal fiscal performance for our clients through comprehensive auditing and detailed audit reports.

In line with our commitment to fostering industry knowledge and best practices, we also run a training center for chartered accountants and tax experts in the UAE, reinforcing our dedication to excellence in auditing services and enhancing internal controls across various sectors.

Why Choose Tulpar Global Taxation For Auditing?

Choosing Tulpar Global Taxation for your auditing needs provides numerous benefits that ensure the accuracy, compliancy, and transparency of your financial operations. We are renowned for our expertise in various auditing services, which include statutory audits, internal audits, and liquidation audits. Here’s why Tulpar stands out:

Expertise and Experience

At Tulpar Global Taxation, we pride ourselves on having a team of highly skilled and certified professionals with extensive experience in various types of audits, including statutory, internal, and liquidation audits. As an audit and accounting firm, our profound understanding of accounting standards and regulatory requirements ensures that every audit is conducted with the highest level of precision and accuracy.

Independence and Objectivity

As an independent audit firm, Tulpar provides impartial and unbiased assessments of your financial statements. This independence ensures that our audit findings are credible and trustworthy, which enhances the confidence of stakeholders, investors, and regulatory bodies in your financial reporting.

Customized and Comprehensive Services

We tailor our audit services to meet the unique needs of each client. Whether you require a thorough statutory audit to ensure regulatory compliancy, an internal audit to assess and improve your internal controls, or a liquidation audit to facilitate the winding-up process, Tulpar provides customized solutions that address your specific requirements and challenges.

Compliance and Risk Mitigation

Our audit services ensure that your organization complies with all relevant laws and regulations. By identifying potential risks and areas of non-compliance, we help you mitigate exposure to liabilities and penalties, thereby safeguarding your business’s financial health and reputation.

Timeliness and Efficiency

Tulpar prioritizes meeting audit deadlines without compromising on quality. Our efficient audit processes and commitment to timely delivery ensure that you receive accurate and reliable audit reports within the required timeframes, facilitating smooth business operations and decision-making.

Confidentiality and Data Security

We uphold strict confidentiality standards and employ robust data security measures to protect your sensitive financial information. This commitment to data protection ensures that your financial data is handled with the utmost care and security throughout the audit process.

How Can We Help You Manage Your Business Auditing in Dubai

Tulpar Global Taxation offers a comprehensive suite of audit services tailored to meet your business auditing needs effectively and efficiently in Dubai, UAE. Here’s how our team of auditors can assist you:

- Annual Audits: We conduct thorough financial statement audits to ensure they provide a true and fair view of your organization’s financial position. Our experienced auditors verify the accuracy of financial transactions, ensure compliancy with accounting standards, and identify any discrepancies that need to be addressed, thereby enhancing financial accuracy.

- Compliance Audits: Our compliance audits assess your adherence to industry-specific regulations and statutory requirements. By ensuring that your business meets all audit requirements, we help you avoid penalties, enhance your regulatory standing, and fulfill your tax obligations while providing valuable insights into your financial matters.

- Internal Control Assessments: Tulpar Global Taxation evaluates your Internal Control Systems, identifying weaknesses and recommending improvements. This service strengthens your financial processes, helps prevent fraud, and ensures the reliability of your financial reporting. Our expert advice facilitates better financial management and addresses potential risks.

- Risk Management and Fraud Prevention: Through comprehensive risk assessments and fraud prevention audits, we help you identify financial risks and implement effective controls to mitigate them. Our proactive approach to risk management ensures the long-term stability and security of your business operations in a dynamic market.

- Asset and Liability Verification: For businesses undergoing liquidation, we provide thorough asset and liability verification services. This ensures the accurate inclusion of all assets and liabilities in the liquidation process, facilitating a transparent and orderly winding-up process.

- Customized Reporting and Insights: Tulpar Global Taxation provides detailed audit reports and actionable insights tailored to your business’s specific needs. These detailed reports highlight audit findings and offer practical recommendations for improving your financial practices, enhancing overall business performance, and achieving your financial goals.

- Business Solutions and Consulting Services: In addition to our auditing services, we offer a range of business consulting services, including financial consultation, corporate services, and administrative services. Our professional accounting and advisory firm are committed to delivering exceptional services that contribute to your success.

By choosing Tulpar Global Taxation, you gain a trusted partner dedicated to delivering excellence in auditing services that enhance your business’s financial transparency, compliancy, and operational efficiency. Contact us today to discuss your auditing needs and discover how our financial advisory team can help you achieve your business objectives in Dubai.

Contact Us:

- Website: www.tulpartax.com

- Email: info@tulpartax.com

- Phone: +971-54 444 5124