Corporate Tax For Free Zone Companies in the UAE

Corporate Tax Law grants a Qualifying Free Zone Person the opportunity to enjoy a 0% Corporate Tax rate on their Qualifying Income.

Table of Contents

Related Articles

OFAC & AML: How to Remove a Company from the OFAC Sanction List

Excise Product Registration in the UAE – 2026

Let's Talk

Sign Up For Free Consultation

Corporate Tax for UAE Free Zone Companies

Running a free zone company in the UAE? The corporate tax bomb dropped in June 2023, 9% on profits over AED 375,000 and it’s got everyone on edge. But here’s the game-changer: you can still pay 0% if you crack the code. One misstep, and the Federal Tax Authority (FTA) will drain your profits faster than you can say “free zone advantage.” Want to master corporate tax for free zone companies in the UAE and keep your cash in 2026? This guide hands you the keys to tax freedom, jump in now and beat the system!

In the United Arab Emirates (UAE), Free Zone companies are entities established within specific economic zones designated by the government to attract foreign investment. These zones offer incentives such as exemption from corporate and personal taxes, customs duty benefits, and the ability to have full foreign ownership rights. As a leading financial center and business hub in the Middle East, the UAE provides advantageous corporate tax structures for companies operating within its borders.

While Free Zone entities may not be fully subject to UAE laws, they must understand the tax regulations and deadlines to ensure compliance. Therefore, this comprehensive guide provides a comprehensive overview of corporate taxation specific to Free Zone companies operating within the United Arab Emirates (UAE).

The Real Deal on UAE Free Zone Corporate Tax

The UAE’s 9% corporate tax sounds like a nightmare, but free zones like JAFZA, DMCC, or RAK ICC get a lifeline: 0% tax as a “Free Zone Person” (FZP). The twist? You’ve got to qualify think export-driven income, real operations, and no mainland tangles. Slip up, and you’re hit with the full 9%. Tulpar Global Taxation Services cuts through the noise to keep you tax-free. Curious how? Read on!

Step 1: Lock In Your 0% Tax Status

To escape the 9% tax, you must nail FZP status. Here’s the playbook:

- Qualifying Income: Focus on exports, free zone trades, or services mainland revenue gets taxed.

- Substance Matters: Prove you’re legit staff, office, not a paper company.

- No Mainland PE: A Permanent Establishment outside the free zone? Kiss 0% goodbye.

One wrong move, and you’re toast. Tulpar Global Taxation Services audits your setup to seal the deal. Click to lock in your tax break now!

Step 2: Register with the FTA Or Face AED 10,000 Fines

Even at 0%, registration is non-negotiable. Miss the FTA deadline, and penalties start at AED 10,000 no mercy. Here’s how to nail it:

- Hit up EmaraTax (FTA’s portal) and sign up.

- Submit financials proving your FZP cred.

- File yearly compliance is king.

Daunted? Tulpar Global Taxation Services makes it quick and painless. Click for your foolproof registration plan!

Step 3: Avoid These Tax Traps or Pay the Price

Free zone tax perks are sweet, but pitfalls can crush you:

- Mixed Income: Mainland sales mixed in? That’s 9% taxable keep it separate.

- Transfer Pricing: Related-party deals must be fair, or the FTA pounces.

- Audit Slips: Weak records = lost FZP status.

Competitors won’t warn you, Tulpar Global Taxation Services does. Click to sidestep these disasters!

Step 4: Supercharge Your Savings Like a Pro

Why settle for 0% when you can optimize further? Try these:

- Tax Grouping: Link free zone entities to offset profits.

- Loss Carryforward: Bank losses to shield future gains.

- Compliance Hacks: Stay FTA-ready with expert books.

Tulpar Global Taxation Services turns these into profit goldmines.

What are Free Zone Companies?

Free zone companies in the UAE are businesses set up in special economic zones like JAFZA, DMCC, or RAK ICC, designed to turbocharge trade with perks like 0% corporate tax, if you qualify as a Free Zone Person (FZP). They thrive on exports, logistics, and free zone-to-free zone deals, dodging the UAE’s 9% tax by sticking to strict rules: real operations, no mainland ties, and qualifying income. One misstep, and the tax break vanishes. Tulpar Global Taxation Services ensures your free zone company stays tax-free and booming.

Overview of UAE Corporate TAX For Free Zone Companies

The UAE introduced a Corporate Tax regime, which also impacts Free Zone Companies, starting from June 2023. Free Zone Companies generally benefit from a 0% corporate tax rate on income derived from activities within their respective zones, subject to meeting certain conditions. These include maintaining adequate substance in the UAE, complying with transfer pricing rules, and not engaging in business activities with mainland UAE entities. However, income earned from mainland UAE or foreign sources may be subject to the standard corporate tax rate of 9%. Free Zone Companies must adhere to the compliance and reporting requirements outlined by the Federal Tax Authority (FTA) to retain their preferential tax status.

The Emaratax portal facilitates the registration, filing, and payment processes for corporate tax, streamlining administrative tasks for Free Zone Companies. Additionally, companies must ensure they do not fall under the definition of Exempt Persons, which includes certain government entities, extractive businesses, and non-extractive natural resource businesses, to qualify for tax benefits. Understanding these regulations is essential for Free Zone Companies to optimize their tax positions while ensuring full compliance with UAE tax laws.

Free Zone Persons vs. Free Zone Companies

Free Zone Persons and Free Zone Companies are distinct classifications within special economic zones established by countries like the UAE and Singapore. They differ in the following ways:

Free Zone Persons: These individuals are granted residency or work permits within a free zone. They typically include employees, investors, or entrepreneurs who operate within the free zone but are not necessarily registered as companies themselves. They benefit from the incentives and regulations of the free zone, such as tax exemptions and simplified administrative procedures.

Free Zone Companies: These are businesses or corporate entities that are registered and operate within a free zone. Free Zone Companies enjoy benefits such as 100% foreign ownership, tax exemptions, customs duty exemptions, and simplified import/export procedures. They are distinct legal entities that can conduct business activities within the free zone and sometimes internationally, depending on the regulations of the specific free zone.

Both Free Zone Persons and Free Zone Companies benefit from the unique incentives and regulatory frameworks provided by Free Zone, which are designed to attract investment, promote economic growth, and facilitate international trade and business operations.

What are Corporate Tax Benefits Enjoyed by Free Zones in the UAE

Free Zones in the UAE offer several corporate tax benefits designed to attract and retain businesses, thereby promoting economic growth and diversification. Here are the key corporate tax benefits that Free Zone entities enjoy:

- 0% Corporate Tax Rate on Qualifying Income: Free Zone entities benefit from a 0% corporate tax rate on income derived from qualifying activities. These activities include manufacturing, processing, holding shares, reinsurance services, fund management, wealth and investment management, logistics, and more. The 0% rate applies as long as the income is generated from within the Free Zone and meets the regulatory requirements set by the UAE authorities.

- Full Foreign Ownership: Free Zone companies are allowed 100% foreign ownership, which is not always permitted in the mainland UAE. This benefit is particularly attractive to international investors and businesses looking to maintain complete control over their operations.

- No Import and Export Duties: Businesses operating in Free Zones enjoy exemptions from import and export duties. This benefit significantly reduces operational costs, especially for companies involved in manufacturing, trading, and logistics.

- Repatriation of Profits and Capital: Free Zone entities can repatriate 100% of their profits and capital without any restrictions. This provision ensures that investors can transfer their earnings back to their home countries without facing any financial barriers.

Exemption from Personal Income Tax: Employees working in Free Zones are exempt from personal income tax. This exemption makes Free Zones an attractive option for both employers and employees, fostering a competitive business environment.

Simplified Business Processes: Free Zones offers streamlined business setup procedures, including faster company registration, licensing, and visa processing. This ease of doing business reduces administrative burdens and helps companies start their operations more quickly.

Customs Duty Exemption: Companies operating in Free Zones are exempt from customs duties on goods imported into the Free Zone. This benefit is crucial for businesses that rely on imported raw materials or products for their operations.

Strategic Locations: Many Free Zones are strategically located near major ports, airports, and logistics hubs. This accessibility enhances trade and export opportunities, making it easier for businesses to reach international markets.These corporate tax benefits make UAE Free Zones highly attractive to international businesses and investors. By providing a favorable tax environment, the UAE encourages foreign direct investment, promotes economic diversification, and supports the growth of various sectors within the country.

Key Differences Between Free Zone and Mainland in UAE

In the UAE, a mainland company is a business entity that is registered and licensed to operate within the boundaries of the UAE mainland, outside of designated free zones. Mainland companies are governed by the UAE Federal Law and the regulations of the respective emirate’s Department of Economic Development (DED). Unlike free zone companies, mainland companies have certain restrictions and benefits that guide their operations in the UAE. These key differences include:

Ownership and Shareholding: In a mainland company, foreign ownership is typically restricted to 49%, with a local sponsor or agent holding the majority stake (51%). Free zones, however, allow 100% foreign ownership, making them attractive to international investors.

Taxation: Mainland companies are subject to UAE corporate tax laws and regulations, including potential taxes on profits and income. Free zone entities often enjoy tax exemptions for extended periods (usually up to 50 years), including no personal income tax and import/export duties.

Business Setup and Licensing: Mainland businesses must register with the Department of Economic Development (DED) and comply with UAE commercial laws. Free zones offer streamlined processes for company setup, often with pre-built infrastructure, simplified licensing procedures, and sometimes specific industry-focused regulations.

Location Restrictions: Mainland businesses can operate anywhere in the UAE and engage in government contracts. Free zone companies, while offering strategic locations and dedicated business environments, may face limitations on operating outside their designated zone without additional approvals.

Employment and Visa Sponsorship: Mainland companies can sponsor visas for employees across the UAE, subject to labor regulations. Free zone entities typically sponsor visas only for employees working within the free zone, though some free zones now allow employees to work outside with special permits.

Regulatory Framework: Mainland companies must adhere to federal laws and regulations governing labor, immigration, and commercial activities. Free zones operate under their regulatory authorities and offer more flexible legal frameworks tailored to specific business sectors.

Choosing between a free zone and a mainland setup depends on factors such as ownership preferences, operational requirements, and the nature of the business activities planned within the UAE.

Who Can be a Qualifying Free Zone Person?

A Qualifying Free Zone Person (QFZP) in the UAE must meet specific criteria to benefit from the 0% corporate tax rate. To be considered a QFZP, a Free Zone Company must:

Maintain Adequate Substance: The company must demonstrate adequate presence and economic substance within the Free Zone. This typically involves having physical offices, and employees, and conducting substantial business activities within the zone.

Income Source: The company’s income should primarily be derived from activities conducted within the Free Zone or from foreign sources. Income from mainland UAE activities is generally subject to the standard 9% corporate tax rate.

Compliance with Transfer Pricing Rules: The company must adhere to the transfer pricing rules and maintain proper documentation to ensure that transactions with related parties are conducted at arm’s length.

No Mainland Business Activities: The company should not conduct business with entities in the mainland UAE unless such activities are specifically permitted under the Free Zone regulations and do not affect the preferential tax status.

Regulatory Compliance: The company must comply with all regulatory requirements, including annual financial statement submissions and any other documentation required by the Free Zone Authority and the Federal Tax Authority (FTA).

Registration and Reporting: The company must be registered with the FTA through the Emaratax portal, and it must comply with all reporting and tax filing obligations.

By meeting these criteria, a Free Zone Company can qualify for the 0% corporate tax rate on its qualifying income, benefiting from the favorable tax regime designed to encourage economic activity within the UAE’s Free Zones.

What is Qualifying Income?

Qualifying Income for Free Zone Companies in the UAE is defined by specific guidelines set out under the UAE Corporate Tax Law, primarily through Cabinet Decision No. 55 of 2023 and Ministerial Decision No. 139 of 2023. To benefit from the preferential 0% corporate tax rate, a Free Zone Company must qualify as a Qualifying Free Zone Person (QFZP) and generate income from specific activities.

The key categories of Qualifying Income include:

Income from Transactions with Other Free Zone Persons:

This income must not come from Excluded Activities. For example, trading or service transactions within the same or other Free Zones fall under this category.

Income from Qualifying Activities with Non-Free Zone Persons:

This pertains to income generated from specific activities with entities outside the Free Zone but within the UAE. Qualifying Activities include manufacturing, processing goods, holding shares and securities, operating ships, regulated reinsurance, fund and wealth management, headquarters and financing services to related parties, aircraft leasing, and logistics, among others.

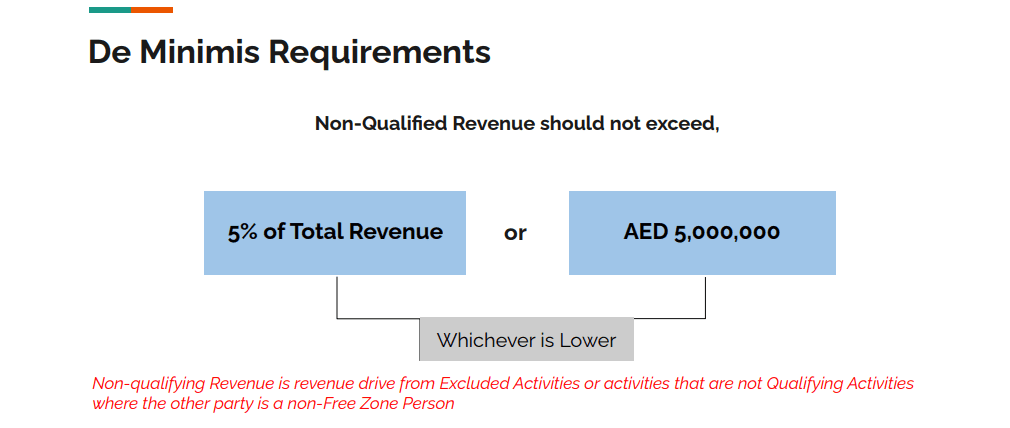

Income that Meets De Minimis Requirements:

To ensure compliance, the total non-qualifying revenue should not exceed 5% of the total revenue or taxable income of AED 5,000,000, whichever is lower. Non-qualifying revenue generally includes income from Excluded Activities or activities that do not fall under Qualifying Activities when conducted with non-Free Zone Persons.

To maintain the 0% tax rate, Free Zone Companies must also ensure they meet substance requirements, such as having adequate physical presence, assets, qualified employees, and incurring sufficient operating expenditures within the Free Zone

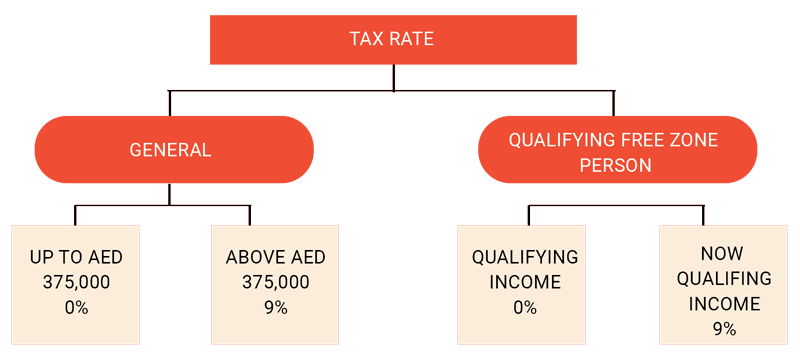

Tax Rates For Free Zones

In the UAE, the corporate tax rates for Free Zone companies depend on their classification as either Qualifying Free Zone Persons (QFZPs) or Non-Qualifying Free Zone Persons (NQFZPs).

Qualifying Free Zone Persons (QFZPs):

QFZPs benefit from a 0% corporate tax rate on their qualifying income. To maintain this status, they must meet several conditions, including conducting qualifying activities, having substantial operations within the free zone, and maintaining audited financial statements within the relevant tax period. Qualifying income generally includes revenue from activities like trading, manufacturing, and certain service provisions within the free zone, as well as transactions with other free zone entities

Non-Qualifying Free Zone Persons (NQFZPs):

NQFZPs, which do not meet the necessary conditions to be classified as QFZPs, are subject to the standard UAE corporate tax regime of 9% on taxable income exceeding AED 375,000. This rate also applies to any non-qualifying income earned by QFZPs, such as income from excluded activities or transactions with the mainland UAE entities.

Key Activities of Qualifying Free Zone Persons

In the UAE, Qualifying Activities for Free Zone entities are those activities that enable them to benefit from a 0% corporate tax rate on their qualifying income. These activities are typically defined and regulated by each free zone authority, outlining the permissible sectors and business types eligible for establishment.

According to the Ministerial Decision No. (265) of 2023, these qualifying activities for corporate tax purposes include:

Manufacturing of Goods or Materials: This activity involves the creation, assembly, or improvement of products and materials from raw materials or components. It includes the entire process from the initial design to the final product. Manufacturing must take place within the Free Zone to qualify for the 0% tax rate. This category covers various industries such as electronics, textiles, machinery, and more.

Processing of Goods or Materials: Processing activities change the form, appearance, or character of goods or materials. This can include refining, mixing, cutting, and other transformations that prepare goods for sale or further manufacturing. Like manufacturing, processing must occur within the Free Zone.

Holding of Shares and Other Securities: Free Zone entities that invest in shares and securities, holding them for at least 12 months for investment purposes, qualify under this category. This activity supports investment holdings, which are crucial for businesses engaged in investment and portfolio management.

Ownership, Management, and Operation of Ships: This includes activities related to maritime logistics, such as owning and managing commercial ships, operating shipping services, and providing related maritime support services. This category is critical for businesses involved in international trade and logistics.

Reinsurance Services: Reinsurance involves insurers transferring portions of their risk portfolios to other parties to reduce the likelihood of paying large obligations resulting from an insurance claim. Free Zone entities offering reinsurance services benefit from the 0% tax rate as long as they comply with regulatory standards.

Fund Management Services: These services involve managing investment funds and assets on behalf of clients. The fund management activities must be under the regulatory oversight of the competent authority in the UAE. This ensures that only authorized and compliant entities can benefit from the tax incentives.

Wealth and Investment Management Services: These services include financial planning, investment advice, and portfolio management. Entities must be regulated by the relevant UAE authority to qualify. This category supports the financial sector by encouraging professional wealth and investment management services.

Headquarter Services to Related Parties: Providing central management, strategic planning, and administrative support to related entities falls under this category. This activity includes high-level decision-making, policy formulation, and overall corporate governance.

Treasury and Financing Services to Related Parties: This includes managing cash flow, financing, and financial risk for related entities. Activities such as lending, borrowing, and cash management between related parties in the Free Zone qualify for the 0% tax rate.

Financing and Leasing of Aircraft: This involves leasing aircraft, engines, and components. Entities engaged in these activities provide crucial support to the aviation sector, facilitating access to aircraft and related equipment.

Logistics Services: Logistics activities cover transportation, warehousing, inventory management, and other support services that ensure the efficient movement and storage of goods. These services are vital for supply chain management and international trade.

Distribution in or from a Designated Zone: Distribution activities must occur within or from a designated Free Zone. This includes importing, storing, managing inventory, and distributing goods. Compliance with specific conditions is necessary to qualify for the tax incentive.

Ancillary Activities: These are activities closely related to the main qualifying activities and support their execution. They contribute minorly to the overall operations but are essential for the primary business functions.

Additionally, income derived from ancillary activities, closely related to the main qualifying activities, is also considered qualifying income. However, any income from excluded activities, such as certain financial services or real estate dealings, is not treated as qualifying income regardless of the source

What is the De Minimis Tax Rule in UAE

The De Minimis Tax Rule in the UAE is a regulatory provision within the Corporate Tax framework that affects businesses operating in Free Zones. This rule specifies that for a Free Zone entity to maintain its status as a Qualifying Free Zone Person (QFZP) and benefit from a 0% corporate tax rate on qualifying income, its non-qualifying revenue must not exceed the lower of 5% of total revenue or AED 5 million.

Non-qualifying revenue includes income derived from excluded activities or activities that are not qualifying activities where the other party is a non-Free Zone person. If a Free Zone entity surpasses this threshold, it loses its QFZP status and is subjected to the standard corporate tax rate of 9% on all income, with a minimum disqualification period of five years. This rule is crucial for ensuring that Free Zone entities remain focused on their designated qualifying activities and do not derive significant income from non-qualifying or excluded activities

Corporate Tax Services For Free Zones

Tulpar Global Taxation offers specialized corporate tax services tailored to businesses operating within the UAE’s free zones. Here’s how we can assist your business:

Comprehensive Tax Advisory: We provide expert advice on tax planning strategies designed to optimize your business’s tax position within the free zone framework. This includes identifying applicable tax incentives, structuring operations to minimize tax liabilities, and maximizing benefits available under local tax laws.

Tax Compliance Services: Our team ensures your business remains fully compliant with UAE tax regulations, including VAT and corporate income tax requirements if applicable. We handle all aspects of tax compliance, from registration and filing to ongoing reporting and record-keeping, tailored specifically for free zone operations.

Tax Optimization Strategies: We develop customized tax optimization strategies that align with your business goals while ensuring adherence to legal requirements. This includes leveraging available exemptions, incentives, and tax treaties to enhance your business’s financial efficiency.

Transfer Pricing Solutions: For businesses engaged in intra-group transactions, we offer comprehensive transfer pricing solutions to establish compliant policies and documentation, minimizing risks associated with transfer pricing audits.

VAT Compliance and Advisory: We provide specialized VAT services, including registration, VAT return preparation, and advisory on VAT implications for transactions within free zones. Our goal is to ensure your VAT compliance while optimizing cash flow and reducing administrative burdens.

Audit Support and Representation: In the event of tax audits or investigations, we provide expert support and representation to ensure your business meets audit requirements and resolves issues efficiently.

Proactive Regulatory Updates: We keep your business informed about regulatory changes, ensuring proactive adaptation to any amendments in tax laws or policies affecting free zone operations.

As one of the leading financial services in Dubai, Tulpar Global Taxation combines deep expertise in UAE taxation with a client-focused approach to enhance your business’s tax efficiency, compliance, and overall financial health within the dynamic environment of UAE-free zones.

Slash YOUR TAX Today!

Don’t let corporate tax rob your free zone company blind. Qualify for 0%, register smart, and outsmart the FTA with this guide. Tulpar Global Taxation Services brings the expertise to make it happen fast. Click now to save big in 2026 your profits are screaming for it!

FAQS:

Yes, Free Zone companies are subject to UAE Corporate Tax; however, they may qualify for a 0% Corporate Tax rate on qualifying income. To benefit from this rate, the company must meet specific conditions set by the UAE Corporate Tax Law. Non-qualifying income is generally taxed at the standard rate.

A Qualifying Free Zone Person is a Free Zone company that meets all regulatory conditions to benefit from the 0% Corporate Tax rate. These conditions include maintaining adequate economic substance, complying with transfer pricing rules, and earning qualifying income. Failure to meet any condition may disqualify the company.

Qualifying income generally includes income earned from transactions with other Free Zone entities and certain international activities. Income from Mainland UAE transactions may be excluded unless specific conditions are met. Proper income classification is critical to avoid unexpected tax liabilities.

Non-qualifying income, such as certain Mainland UAE income, is subject to the standard Corporate Tax rate. If a Free Zone company fails to meet QFZP conditions, all taxable income may become subject to tax. Understanding income categorization is essential for compliance.

Yes, all Free Zone companies must register for Corporate Tax, even if they expect to benefit from the 0% rate. Registration is mandatory regardless of taxable income. Failure to register can result in penalties.

Yes, Free Zone companies must file annual Corporate Tax returns with the Federal Tax Authority. This applies even if the company qualifies for the 0% rate. Accurate filing is essential to maintain tax benefits.

Free Zone companies must comply with UAE transfer pricing regulations for related-party transactions. Transactions must follow the arm’s length principle and be properly documented. Non-compliance can lead to penalties and loss of QFZP status.

If a Free Zone company fails to meet QFZP conditions, it may lose eligibility for the 0% rate. In such cases, the company’s taxable income may be subject to the standard Corporate Tax rate. Regaining status may take time and corrective action.

VAT and Corporate Tax are separate but interconnected compliance frameworks. Inconsistencies between VAT returns and Corporate Tax filings can trigger audits. Aligning both systems is crucial for overall tax compliance.

Free Zone companies should conduct regular compliance reviews, maintain proper documentation, and monitor qualifying income conditions. Working with experts like Tulpar Global Taxation helps ensure compliance, protect tax benefits, and reduce risk.