What are Different Business Licensing Options in UAE - 2026

In the UAE, businesses can choose from a variety of licensing options including commercial, professional, and industrial licenses, each tailored to specific activities and regulatory requirements. Understanding these options helps entrepreneurs, finance professionals, and consultants ensure legal compliance, streamline operations, and optimize growth opportunities in the UAE market.

Table of Contents

Related Articles

OFAC & AML: How to Remove a Company from the OFAC Sanction List

Excise Product Registration in the UAE – 2026

Let's Talk

Sign Up For Free Consultation

Different Business Licensing Options in UAE

Starting a business in the United Arab Emirates (UAE) can be a complex process, requiring more than just identifying market gaps, developing products or services, and managing operational essentials. One crucial yet sometimes overlooked step is obtaining a trade license, a legal requirement for operating a business in the UAE. This license not only legitimizes your business but also enables you to engage in commercial activities.

Issued by the UAE Economic Department, the process and requirements for obtaining a trade license can vary across different emirates. In this blog post, we’ll delve into the various business licensing options available in the UAE to help you navigate this critical step in your entrepreneurial journey.

What is a Business License?

A business license is an official document issued by a government authority that grants permission to operate a business within a specific jurisdiction. It serves as proof that the business has met all the legal requirements and regulations necessary to conduct its activities.

In most cases, obtaining a business license is a mandatory step for businesses of all sizes, as it ensures that the business is recognized by the government and complies with local laws, including tax obligations, safety standards, and other regulations specific to the industry.

Why Do Businesses Need a Business License in the UAE?

Businesses need a business license in the UAE to operate legally and align with the country’s regulatory and compliance requirements. A business license is a legal necessity that allows companies to engage in commercial activities, ensuring they meet the specific rules and standards of their industry. It acts as official government approval for the business to function, safeguarding against potential legal issues and penalties for non-compliance.

In addition to legal authorization, a business license enables companies to access essential services, such as opening corporate bank accounts, applying for employee visas, and entering into contracts. It also enhances the company’s credibility and trustworthiness, which is crucial in building relationships with clients, partners, and investors. Furthermore, having a business license can be beneficial when seeking financing or expanding operations, as it demonstrates that the company is operating within the legal framework of the UAE.

Failing to obtain a business license can result in severe consequences, including fines, business closure, and potential legal action. Therefore, securing the appropriate license is a fundamental step for any business aiming to thrive in the competitive and regulated market of the UAE.

Difference between A Trade License & Business License in the UAE

In the UAE, a trade license and a business license are often used interchangeably, but they have distinct purposes. A trade license specifically authorizes a company to conduct activities related to trade, such as buying and selling goods or services within the approved industry sectors. It is one of the primary categories under the broader business licensing system and is essential for companies involved in commercial, industrial, or professional activities.

On the other hand, a business license is a broader term that encompasses various types of licenses, including trade licenses, professional licenses, and industrial licenses, depending on the nature of the business. While a trade license focuses on commercial transactions, a business license can cover a wider range of activities, such as manufacturing, consultancy, or service-oriented businesses.

In essence, a trade license is a specific type of business license tailored for trading activities, while a business license can represent different types of authorizations based on the business’s operations.

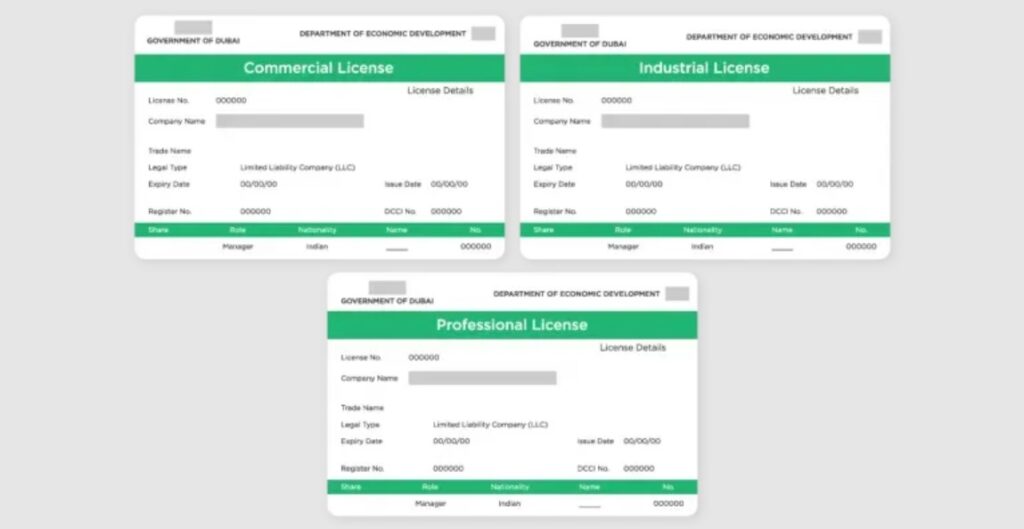

Types of Business Licenses in UAE & How To Get It ?

In the UAE, obtaining the right business license is a crucial step in setting up your business. The type of license you need depends on your business activity, company structure, and location. Here’s an overview of the main types of business licenses in the UAE and how to obtain them:

1. Commercial License

A commercial license serves as an official recognition that a business has met the necessary legal and regulatory requirements to operate. It is designed to ensure that businesses comply with industry standards, safety regulations, and zoning laws, providing a layer of protection for consumers and the community.

Types of Commercial Licenses

The specific type of commercial license required can vary based on the nature of the business and the jurisdiction. Common types include:

- Retail License: For businesses involved in selling goods directly to consumers.

- Food Service License: Required for establishments serving food and beverages.

- Professional License: For individuals offering professional services such as legal, medical, or financial services.

- Manufacturing License: For businesses engaged in the production of goods.

- Service License: For businesses providing services, such as repair or maintenance.

How To Obtain a Commercial License in the UAE

To obtain a commercial license in the UAE, follow these steps:

- Choose a Business Activity: Define your business activities as the license type depends on them.

- Select a Business Structure: Decide on the legal structure of your business (e.g., LLC, sole proprietorship).

- Register Your Trade Name: Choose and register a trade name with the Department of Economic Development (DED) or relevant free zone authority.

- Prepare Documents: Gather required documents such as passport copies, proof of residence, and any additional permits depending on your business activity.

- Submit Application: Apply for the commercial license through the DED or a free zone authority, providing all necessary documentation.

- Pay Fees: Pay the applicable fees for the license and any associated approvals.

- Receive License: Once approved, you will receive your commercial license, allowing you to start operations.

2. Industrial License

An industrial license in the UAE is a permit that authorizes businesses to engage in manufacturing and industrial activities.This license allows businesses to conduct industrial operations legally within the UAE. This license ensures that the business complies with local regulations and standards related to manufacturing and industrial processes. It is crucial for companies that plan to set up production facilities, engage in large-scale manufacturing, or manage industrial operations.

Types of Industrial Licenses

Industrial licenses are generally categorized based on the type of industrial activity:

- Manufacturing License: For companies involved in the production of goods.

- Processing License: For businesses that process raw materials into finished products.

- Assembly License: For companies engaged in assembling products from various components.

How To Obtain an Industrial License in the UAE

To obtain an industrial license in the UAE, follow these steps:

- Define Industrial Activity: Identify the specific type of industrial activity, such as manufacturing or processing, to determine the exact licensing requirements.

- Choose Business Structure: Select your business structure (e.g., Limited Liability Company (LLC), joint venture) as it affects the application process.

- Select a Location: Choose a location within an industrial or free zone, which often provides facilities and infrastructure for industrial operations.

- Register Trade Name: Choose and register a trade name with the Department of Economic Development (DED) or the relevant free zone authority. Ensure the name complies with local regulations.

- Prepare Required Documents: Compile necessary documents, including:

- A completed application form.

- A detailed business plan.

- Proof of identity for the business owner(s) and partners.

- Proof of business address (e.g., lease agreement).

- Technical and environmental approvals if required.

- Submit Application: Submit your application along with the required documents to the DED (for businesses outside free zones) or the free zone authority (for businesses within free zones).

- Pay Fees: Pay the application and licensing fees, which vary based on the type of business and location.

- Complete Inspections: Comply with any required inspections or approvals, such as health, safety, and environmental assessments.

- Receive License: After approval and completion of inspections, you will receive your industrial license, allowing you to commence operations legally.

3. Professional License

A professional license in the UAE is a permit required for individuals or entities providing professional services. It authorizes individuals or companies to offer specific professional services legally. It ensures that practitioners meet the necessary qualifications and comply with local regulations. This type of license is crucial for maintaining the quality and integrity of professional services, such as legal, medical, accounting, or consultancy services.

Types of Professional Licenses

Common types of professional licenses include:

- Legal License: For lawyers and legal consultants.

- Medical License: For doctors, dentists, and other healthcare professionals.

- Accounting License: For accountants and auditors.

- Consultancy License: For business consultants and advisors.

How To Obtain a Professional License in the UAE

To obtain a professional license in the UAE, follow these steps:

- Determine the License Type: Identify the specific type of professional license required based on the services you plan to offer (e.g., legal, medical, accounting, consultancy).

- Choose a Business Structure: Decide on the legal form of your business (e.g., sole proprietorship, partnership, or a professional firm).

- Select a Location: Choose a location for your business, either in a free zone or mainland, based on your business needs and the type of services offered.

- Register Trade Name: Choose a trade name for your business and ensure it complies with the UAE’s naming regulations. Register the name with the Department of Economic Development (DED) or the relevant free zone authority.

- Prepare Required Documents: Gather and prepare the necessary documents, which typically include:

- Proof of professional qualifications and certifications relevant to your field.

- Valid passport copies of the business owner(s) and partners.

- Proof of residence in the UAE (if applicable).

- A business plan detailing the scope of services and operational plans.

- Proof of business address (e.g., lease agreement).

- Submit Application: Apply for the professional license through the DED (for mainland businesses) or the relevant free zone authority (for free zone businesses). Ensure that all documents are submitted accurately.

- Pay Fees: Pay the required application and licensing fees. The cost varies depending on the type of professional service and location.

- Fulfill Additional Requirements: Depending on your profession, you may need to meet additional requirements such as passing specific exams, obtaining approvals from professional bodies, or providing evidence of experience.

- Complete Inspections (if applicable): Some professions may require inspections or additional approvals related to your business premises or professional practice.

- Receive License: Upon approval of your application and successful completion of any additional requirements, you will receive your professional license. This allows you to legally offer professional services in the UAE.

4. Tourism License

A tourism license in the UAE is a permit that authorizes businesses to operate within the tourism sector, including travel agencies, tour operators, hotel management, and other tourism-related services. Core services include providing services such as organizing tours, booking travel arrangements, managing hotels, and offering related services. The license ensures compliance with UAE regulations and promotes a standardized level of service quality in the tourism sector.

Types of Tourism Licenses

- Travel Agency License: For businesses involved in booking and selling travel services.

- Tour Operator License: For companies organizing and conducting tours and excursions.

- Hotel Management License: For businesses managing and operating hotels and accommodation services.

- Tourist Transport License: For companies providing transportation services for tourists, such as shuttle services or car rentals.

How To Obtain a Travel License in the UAE

To obtain a travel license in the UAE, follow these steps:

- Define Business Scope: Determine the specific travel services you will offer, such as booking travel arrangements, organizing tours, or providing travel consultancy.

- Choose a Business Structure: Decide on the legal structure of your business (e.g., Limited Liability Company (LLC), sole proprietorship, or partnership).

- Select a Location: Choose a location for your travel agency, either in a mainland area or a designated free zone that supports travel and tourism activities.

- Register Trade Name: Select a trade name for your travel agency and register it with the Department of Economic Development (DED) or the relevant free zone authority. Ensure the name complies with UAE regulations.

- Prepare Required Documents: Collect and prepare the necessary documents, including:

- Completed application form.

- Proof of identity and residence of the business owner(s).

- Proof of business address (e.g., lease agreement).

- A detailed business plan outlining your travel services and operational strategy.

- Proof of relevant qualifications or experience in the travel industry (if applicable).

- Submit Application: Apply for the travel license through the DED (for mainland businesses) or the relevant free zone authority (for free zone businesses), including all required documents.

- Pay Fees: Pay the application and licensing fees, which vary based on the type of services and location.

- Complete Additional Requirements: Fulfill any additional requirements, such as obtaining approvals from tourism authorities or undergoing inspections, if necessary.

- Receive License: Once your application is approved and all requirements are met, you will receive your travel license, allowing you to operate your travel agency legally in the UAE.

How To Renew Business Licenses in the UAE?

Renewing a business license in the UAE involves a series of steps that ensure your business remains compliant with local regulations. Here’s a comprehensive guide to the process:

- Review Expiration Dates: Before starting the renewal process, check the expiration date of your current business license to ensure timely renewal and avoid any potential penalties or interruptions in business operations.

- Update Required Documents: Gather and update the necessary documents for renewal. These typically include:

- A copy of the current business license.

- A copy of the trade license.

- A copy of the company’s tenancy contract.

- A copy of the company’s memorandum of association (MOA) or articles of association (AOA).

- A copy of the company’s current bank account statement.

- Any additional documents requested by the relevant licensing authority.

- Check for Compliance: Ensure that your business complies with all local regulations and requirements, including any updates in business activity, company structure, or premises. Make any necessary adjustments to meet these requirements before applying for renewal.

- Submit Renewal Application: Depending on your business location, submit your renewal application through the relevant authority. In Dubai, for example, this would be the Department of Economic Development (DED). You can often complete this process online through their e-services portal. For other emirates, the renewal application might be submitted to the respective local authority.

- Pay Renewal Fees: Pay the required renewal fees. The fee amount may vary depending on your business activity and the emirate in which you are operating. Ensure that you have a valid payment method and keep the receipt for your records.

- Receive Renewed License: Once your application is processed and approved, you will receive your renewed business license. This may be issued electronically or as a physical document, depending on the emirate and the method of application.

- Update Business Records: After receiving your renewed license, update your business records, including any changes to your license information, and ensure that all business operations reflect the new validity period.

- Compliance with Local Regulations: Regularly check for any changes in local regulations or requirements to maintain compliance and avoid issues during future renewals.

How Can Tulpar Help You Get a Business License in the UAE?

Starting a business in the UAE involves obtaining the appropriate license, which can be challenging due to regulatory complexities. Without expert assistance, you may face delays or compliance issues that could affect your business operations.

At Tulpar Global Taxation, we simplify the business licensing process for you. Our team offers expert guidance on selecting the right license, preparing required documents, and navigating the application process. We manage trade name registration, fee payments, and ensure compliance with all regulatory requirements. With our streamlined approach, we make obtaining your UAE business license efficient and hassle-free. Ready to start your business journey? Contact Tulpar Global Taxation for expert support and tailored solutions.

FAQs:

The UAE offers three main types of business licenses: Commercial, Professional, and Industrial. Each license type is issued based on the nature of business activities. Choosing the correct license is essential for legal compliance and smooth operations.

A Commercial License is required for businesses involved in trading activities such as import, export, retail, or wholesale. It covers activities like general trading, e-commerce, and distribution. This license is commonly used by trading companies across the UAE.

A Professional License is issued to service-based businesses such as consultants, auditors, IT professionals, designers, and legal advisors. It focuses on professional skills and expertise rather than trading. Many professionals prefer this license for flexibility and ownership benefits.

An Industrial License is required for manufacturing, processing, or industrial production activities. Businesses involved in assembling, packaging, or industrial operations must obtain this license. Additional approvals from authorities may be required depending on the activity.

Mainland licenses allow businesses to operate anywhere in the UAE and trade directly with the local market. Free Zone licenses are ideal for international trade, online businesses, and cost-effective setups, but may have restrictions on Mainland trading. The choice depends on your target market.

Yes, the UAE allows 100% foreign ownership for most business activities, both in Mainland and Free Zones. This has made the UAE highly attractive to global investors and entrepreneurs. Ownership rules may vary for certain regulated sectors.

Tax obligations depend on business turnover and activities, not just the license type. Businesses may need VAT registration and must comply with Corporate Tax regulations, even if they qualify for 0% tax. Proper tax planning is crucial at the licensing stage.

Choosing the right license depends on your activity, target market, budget, and long-term goals. Incorrect licensing can lead to penalties or operational restrictions. Professional advice helps avoid costly mistakes.

The process can take anywhere from a few days to a few weeks, depending on the license type and authority. Free Zones often offer faster setups, while Mainland licenses may require additional approvals. Proper documentation speeds up the process.

Business setup and tax professionals provide end-to-end support, from license selection to compliance planning. Working with Tulpar Global Taxation ensures your business license aligns with UAE regulations, tax requirements, and growth objectives.