How To Calculate Excise Tax In UAE

Table of Contents

Related Articles

Sugar Tax Reform Will Crush Small UAE Drink Brands

The Impact of CARF on UAE Crypto Traders | Ready to Report FTA

Let's Talk

Sign Up For Free Consultation

How To Calculate Excise Tax In UAE

Since October 2017, the introduction of the Excise Tax in the United Arab Emirates (UAE) has been instrumental in both boosting government revenue and deterring the consumption of harmful products such as tobacco, energy drinks, and carbonated beverages. Consequently, it is essential for businesses operating in these sectors to adhere strictly to excise tax regulations.

A key aspect of compliance for a taxable person involves accurately calculating and paying the required taxes on these goods. If you are unsure about how to calculate this, this blog post will take you through the steps to effectively calculate your excise tax to ensure compliance and avoid penalties.

What is Excise Tax?

Excise tax is an indirect tax imposed on the sale or consumption of specific goods, typically those that are considered harmful to individuals or the environment. It is often applied to products such as tobacco, alcohol, energy drinks, carbonated beverages, and luxury items.

While the purpose of excise taxes can vary depending on the country and other factors, it is most commonly used to generate revenue for the government and reduce the consumption of these goods by making them more expensive. Governments use excise taxes to address public health concerns, and environmental issues, or to control consumption patterns.

What Good Are Subject to Excise Tax in the UAE

The UAE imposes excise taxes on the following products or goods:

Tobacco Products: Including cigarettes, cigars, and other tobacco products.

Carbonated Drinks: Beverages with added sugar or sweeteners.

Energy Drinks: Beverages containing stimulants or substances that enhance physical performance.

Electronic smoking devices and tools

Liquids used in such devices and tools

Sweetened drinks.

These goods are targeted due to their potential impact on public health and consumption patterns. The Excise Tax aims to both generate revenue for the government and promote healthier lifestyle choices among consumers.

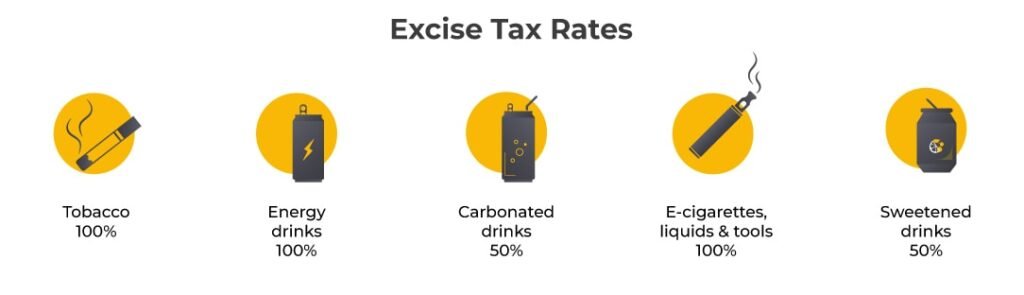

Excise Tax Rates in UAE

The UAE under Cabinet Decision No. 52 of 2019, which addresses Excise Goods, Excise Tax Rates, and Methods for Calculating Excise Prices, here are the Excise Tax rates applicable in the UAE:

Carbonated drinks (50% rate): This tax applies to beverages that contain added sugar or sweeteners. The 50% rate aims to discourage excessive consumption of sugary drinks, which can contribute to health issues such as obesity and diabetes.

Tobacco products (100% rate): Tobacco products, including cigarettes, cigars, and other forms of tobacco, are subject to a 100% excise tax. This high exrate is intended to reduce smoking rates and mitigate the associated health risks.

Energy drinks (100% rate): Energy drinks, which typically contain stimulants like caffeine, are taxed at a 100% rate. This tax is designed to discourage consumption and reduce health effects, particularly among younger individuals.

Electronic smoking devices (100% rate): Devices used for electronic smoking, including e-cigarettes and vaping devices, are subject to a 100% excise tax. This tax reflects concerns over the growing popularity of vaping among young people.

Liquids used in electronic smoking devices and tools (100% rate): Liquids used in electronic smoking devices, which often contain nicotine and flavorings, are taxed at a 100% rate.

Products with added sugar or other sweeteners (50% rate): Aside from carbonated drinks, any other products that contain added sugar or sweeteners are subject to a 50% excise tax. T

Keep in mind that these high excise tax rates are part of the UAE government’s strategy to promote public health, discourage the consumption of harmful substances, and generate revenue for societal be

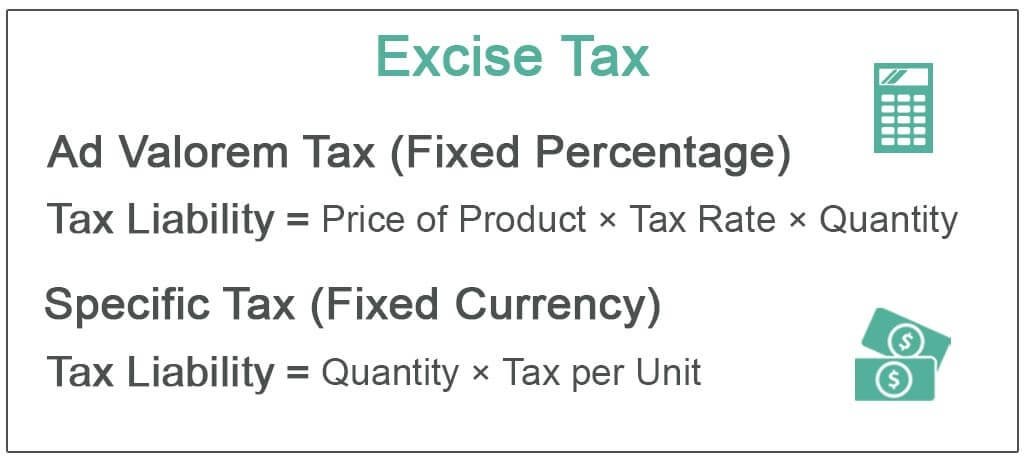

Methods of Calculating Excise Tax UAE

In the UAE, the methods of calculating Excise Tax vary based on the type of goods. Generally, the excise tax calculation can be done using the following methods:

1. Specific Rate Method:

Under this method, Excise Tax is imposed at a fixed tax rate per unit of the excisable goods. For example, a specific excise tax amount might be charged per pack of cigarettes, per liter of energy drink, or per gram of tobacco. This approach ensures that each unit of the product incurs a consistent tax burden, regardless of its price or value in the market.

2. Ad Valorem Method:

The Ad Valorem method calculates Excise Tax as a percentage of the average retail selling price of the goods or based on the product’s value. This means that the tax liability increases or decreases in proportion to the value of the product sold. For instance, if a tobacco product has an Ad Valorem rate of 100%, then the tax amount would be equal to 100% of the product’s retail price. On the other hand, jewelry may be subject to a 5% excise tax based on its retail value.

3. Combined Method:

These methods are carefully selected to achieve specific policy objectives, such as discouraging the consumption of harmful products like tobacco and energy drinks, promoting public health, and generating revenue for government initiatives. The UAE government periodically reviews and adjusts these methods to ensure they remain effective in achieving these goals while also considering economic factors and consumer behavior.

How to Calculate Excise Tax in UAE?

Here are examples of how Excise Tax is calculated in the UAE using both the specific rate method and the ad valorem method:

Example 1: Specific Rate Method

Excise Tax Rate: 100% per liter of energy drink.

Quantity of Goods: 1,000 liters of energy drink.

Calculation: Excise Tax = Quantity × Specific Rate

Excise Tax = 1,000 liters × 100% (or 1.00 AED per liter)

Excise Tax = 1,000 liters × 1.00 AED/liter

Excise Tax = 1,000 AED

Using this example, for 1,000 liters of energy drinks subject to an Excise Tax rate of 100% per liter, the calculated Excise price is 1,000 AED.

Example 2: Ad Valorem Method

Excise Tax Rate: 100% of the retail selling price.

Retail Price of Goods: 200 AED per pack of cigarettes.

Calculation: Excise Tax = Retail Price × Ad Valorem Rate

Excise Tax = 200 AED × 100% (or 1.00, since it’s a multiplier)

Excise Tax = 200 AED × 1.00

Excise Tax = 200 AED

In this example, for a pack of cigarettes with a retail price of 200 AED and an Excise Tax rate of 100% (equal to the retail price), the calculated Excise Tax amount is also 200 AED.

Combined Method Example

Specific Rate Component: 2 AED per unit.

Ad Valorem Rate: 50% of the retail selling price.

Quantity of Goods: 500 units.

Suggested Retail Price of Goods: 100 AED per unit.

Calculation:

Calculate the Specific Rate Component:

Specific Excise Tax = Quantity × Specific Rate

Specific Excise Tax = 500 units × 2 AED/unit

Specific Excise Tax = 1,000 AED

Calculate the Ad Valorem Component:

Ad Valorem Excise Tax = Retail Price × Ad Valorem Rate

Ad Valorem Excise Tax = 500 units × 100 AED/unit × 50% (0.50)

Ad Valorem Excise Tax = 25,000 AED

The Total Excise Tax rate:

Total Excise Tax = Specific Excise Tax + Ad Valorem Excise Tax

Total Excise Tax = 1,000 AED + 25,000 AED

Total Excise Tax = 26,000 AED

In this combined method example, for a product with a specific rate of 2 AED per unit and an ad valorem rate of 50% of the retail price (100 AED per unit), the calculated total Excise Tax amount is 26,000 AED for 500 units sold.

Excise Tax Advisory in UAE

Excise Tax advisory in the UAE is crucial for businesses handling taxes on goods like tobacco, energy drinks, and sugary products. Effective advisory services are essential for ensuring compliance with UAE Excise Tax laws, which include understanding specific tax rates, calculation methods, and reporting requirements.

Expert advisors, such as those at Tulpar Global Taxation, provide tailored guidance to optimize tax planning, minimize liabilities, and enhance operational efficiency. Services typically include comprehensive audits, compliance reviews, and ongoing support to interpret regulatory changes and maintain accurate reporting.

By partnering with experienced advisors, businesses can confidently manage their applicable taxes, mitigate risks of non-compliance, and strategically align with evolving tax regulations in the UAE. This proactive approach not only supports legal compliance but also fosters a competitive advantage through efficient tax management practices.

Excise Tax is an indirect tax levied on specific goods considered harmful to health or the environment. It applies mainly to tobacco products, e-cigarettes, energy drinks, soft drinks, and sweetened beverages. The tax is regulated by the Federal Tax Authority (FTA).

The UAE Excise Tax rates are:

100% on tobacco products, e-cigarettes, and energy drinks

50% on soft drinks and sweetened beverages

These rates are applied to the excise tax base, not the selling price alone.

The excise tax base is the higher of:

The retail selling price (RSP), or

The cost price plus profit margin

The FTA sets minimum retail prices for certain excisable goods, which must be considered during calculation.

Formula:

Excise Tax = Excise Tax Base × 100%

Example:

Excise Tax Base = AED 10,000

Excise Tax = 10,000 × 100% = AED 10,000

Formula:

Excise Tax = Excise Tax Base × 50%

Example:

Excise Tax Base = AED 10,000

Excise Tax = 10,000 × 50% = AED 5,000

Excise Tax becomes payable when excisable goods are imported, produced, released for consumption, or stockpiled. Monthly Excise Tax returns must be filed through the FTA portal.

Statutory audits are generally conducted annually, based on the company’s financial year. Timely completion is important to meet regulatory deadlines. Delays can affect license renewals and regulatory compliance.

Manufacturers, importers, stockpilers, wholesalers, and distributors of excisable goods must calculate and pay Excise Tax. Free Zone companies are not exempt if they deal in excisable products.

Common mistakes include using the wrong tax base, ignoring FTA minimum retail prices, and miscalculating VAT on excise-inclusive values. These errors often result in heavy penalties during FTA audits.

Excise Tax is complex and highly scrutinized by the FTA. Working with Tulpar Global Taxation helps businesses ensure accurate Excise Tax calculation, proper registration, return filing, and audit readiness.