VAT Deregistration UAE - 2026

According to the UAE Federal Tax Authority (FTA), taxpayers are required to submit the VAT deregistration within 20 business days from the occurrence of the event that necessitates deregistration.

Table of Contents

Related Articles

OFAC & AML: How to Remove a Company from the OFAC Sanction List

Excise Product Registration in the UAE – 2026

Let's Talk

Sign Up For Free Consultation

UAE VAT Deregistration

In the United Arab Emirates (UAE), a financially stringent approach mandates that every business and individual conducting operations within its borders must register for VAT and regularly pay their taxes. This regulation strengthens the nation’s financial foundation. However, businesses encountering difficulties in meeting their tax obligations have the option to apply for cancelling VAT registration. The Federal Tax Authority (FTA) provides VAT de-registration services to facilitate this process. How to navigate VAT deregistration in UAE? Find out the process of canceling VAT registration and simplifying your financial management.

The VAT deregistration procedure allows eligible businesses to deregister for VAT in UAE, thereby alleviating administrative burdens and simplifying financial management. It’s crucial to understand that not all businesses qualify for VAT deregistration in the UAE; only those who have ceased making taxable supplies or whose taxable turnover has fallen below the threshold may be eligible.

Businesses must apply for deregistration of VAT in UAE within 20 business days of meeting the criteria. This process is vital, as it ensures compliance with regulations and avoids unnecessary penalties. Entities considering voluntary deregistration for VAT should be aware that they must file a tax return for the last tax period before cacelling VAT registry.

Understanding how to navigate the VAT landscape is essential for any business operating in the UAE. In this blog post, we will provide comprehensive insights into the deregistration VAT UAE procedure, covering key aspects such as the reasons for deregistering, the importance of timely applications, and expert advice on maintaining compliance with UAE VAT regulations.

6Whether you are looking to deregister or just starting with registering VAT in the UAE, this VAT deregistration guide will equip you with the necessary knowledge to manage your VAT obligations effectively, ensuring your business remains compliant with the Federal Tax Authority’s VAT deregistration requirements.

What is VAT Deregistration in UAE?

VAT deregistration in the UAE refers to the formal process by which a business or individual cancels their VAT registration and suspend registraion with the FTA. This process is crucial when an entity no longer needs to be VAT registered, typically due to ceasing taxable activities or when its revenue falls below the mandatory registration threshold. When a business decides to deregister from VAT, it can significantly reduce the administrative and financial burdens associated with VAT compliance. The VAT deregistration procedure entails submitting an application for deregistration through the FTA’s online portal. Businesses must provide necessary documentation and justification for their deregistration application.

It is important to note that businesses must apply for VAT cancellation within 20 business days of meeting the criteria. Additionally, entities opting for voluntary deregistration must comply with the VAT law and submit a final VAT return prior to the cancellation. Failure to adhere to these requirements may result in a penalty of AED for non-compliance. Upon applying to cancel VAT, the FTA will review the application and confirm the date of registration cancellation. Businesses should ensure that they submit their final tax return and follow the process of VAT cancellation diligently. With proper adherence to the guidelines, businesses can successfully navigate the VAT deregistration services offered in Dubai and the wider UAE.

In summary, understanding the steps involved in the VAT deregistration procedure is essential for any business looking to de-register from VAT efficiently. The FTA provides VAT de-registration services to assist entities throughout this process, ensuring compliance and a smooth transition away from VAT obligations.

Why is VAT Deregistration Important For Businesses in the UAE

An e-commerce license is a legal permit that enables businesses and individuals to operate and conduct commercial activities online. It authorizes companies to sell products or services through digital platforms, including their own websites or online marketplaces like Amazon, eBay, or AliExpress. In regions like Dubai, obtaining an e-commerce license is not only a regulatory requirement for starting an online business but also essential for ensuring compliance with local laws and regulations. For businesses registered for VAT, understanding the implications of VAT deregistration is crucial, especially if they decide to cease operations or change their business model.

A texable person is required to apply for VAT de-registration when they no longer need to be VAT registered, but it should be within stipulated time frame. The deregistration application process requires the business to provide relevant information, including the deregistration date and any supporting documentation. Once the application is submitted, the authority will cancel the VAT registry if all criteria are met. It’s essential for businesses to cancel their VAT registry if they are no longer making taxable supplies or if they fall below the required thresholds. This ensures compliance with VAT laws and prevents unnecessary obligations, such as filing VAT returns. By properly managing their VAT status, e-commerce businesses can focus on their core operations while adhering to regulatory standards.

In summary, securing an e-commerce license and understanding the process of VAT deregistration are both critical for any business looking to thrive in the digital marketplace. Ensuring compliance with local regulations protects consumer rights and promotes fair trade practices, ultimately leading to a successful online venture.

The Benifits of VAT Deregistration in Dubai - UAE

VAT deregistration is a critical consideration for businesses in the UAE, offering several important benefits.

Here are five key reasons why it is important:

Cost Savings: Deregistering from VAT can lead to significant cost savings by reducing the administrative and financial burdens associated with VAT compliance. This includes filing VAT returns and maintaining detailed records, ultimately lowering operational costs.

Streamlined Operations: When businesses no longer need to manage their VAT registering obligations, they can focus more on their core activities, enhancing overall operational efficiency. This allows them to dedicate resources to delivering goods or services without the complexities of VAT compliance.

Regulatory Compliance: Ensuring that a business is registered for VAT only when necessary helps maintain compliance with UAE tax laws. By applying for the cancellation of VAT registry at the right time, businesses can avoid potential fines or VAT canceling penalties associated with being incorrectly registered.

Simplified Accounting: The VAT deregistration process in UAE simplifies accounting processes, especially for smaller businesses or those with reduced taxable activities. This makes financial management easier, allowing businesses to focus on growth rather than administrative tasks.

Cash Flow Management: Without the obligation to collect and remit VAT, businesses can improve their cash flow, allowing for better allocation of resources and enhanced financial planning. Once the deregistration application is approved, they can redirect those resources toward other critical areas of their operations.

It’s important to note that businesses cannot apply for deregistration if they have outstanding VAT obligations or if they have not met the criteria set by the FTA VAT guidelines. To successfully cancel their VAT registry, businesses must submit a deregistration application and ensure that it is approved before ceasing VAT-related activities. Additionally, businesses must be aware of the mandatory deregistration requirements and the consequences of not adhering to these guidelines, including potential late VAT deregistration penalties.

In conclusion, VAT cancellation allows businesses in the UAE to operate more efficiently and cost-effectively when they no longer meet the requirements for VAT registry. By navigating the VAT registration cancellation process carefully, businesses can ensure compliance while optimizing their operational strategies.

VAT Deregistration Conditions in UAE

VAT deregistration is a structured process that ensures businesses and tax groups are compliant with UAE tax laws while optimizing their financial and administrative efficiency. If a business is voluntarily registered under VAT and no longer meets the criteria for registration, it can initiate the process. To do so, businesses must submit a deregistration application using the appropriate application form provided by the FTA. It’s crucial to complete the VAT cancellation within 20 business days of deciding to deregister to ensure compliance and avoid any penalties. Here’s an overview of the key conditions for deregistration in the UAE:

Voluntary Deregistration

Voluntary VAT de-registration in the UAE applies to businesses that registered for VAT voluntarily and later decide they no longer need to be registered.

The conditions include:

Turnover Below the Voluntary Threshold: If a business’s taxable turnover falls below the voluntary registration threshold of AED 187,500, it can apply for deregistration.

Twelve-Month Criteria: The business must demonstrate that its turnover has remained below the voluntary threshold for the past 12 months.

Ceasing Taxable Supplies: If the business ceases to make taxable supplies and does not anticipate making any in the future, it can opt for voluntary deregistration.

Mandatory Deregistration

Mandatory VAT cancellation is required for businesses that no longer meet the criteria for mandatory VAT registration. The conditions include:

Ceasing Taxable Activities: If a business stops making taxable supplies and does not plan to resume such activities within the next 12 months, it must apply for deregistration.

Turnover Below Mandatory Threshold: If a business’s taxable turnover falls below the mandatory registration threshold of AED 375,000 per annum for a continuous period of 12 months, it is required to deregister.

Compliance with FTA Rules: The business must ensure all due taxes are paid and compliance requirements are met before deregistration.

VAT Deregistration for Groups

VAT deregistration for tax groups involves additional considerations due to the collective nature of the registration. The conditions include:

Group Disbandment: If the group disbands or no longer meets the criteria for group registration, it must apply for deregistration.

Member Leaving the Group: If a member leaves the group and the remaining members no longer meet the criteria for group registration, deregistration is required.

Change in Business Structure: Significant changes in the business structure of the group that affect its eligibility for VAT registration necessitate deregistration.

Compliance and Settlements: The group must ensure all outstanding tax liabilities and compliance obligations are settled before deregistration.

VAT Deregistration Application in UAE

The VAT deregistration application process in the UAE is straightforward but requires careful adherence to FTA guidelines. Before continuing this process, it is crucial that you meticulously calculate your annual taxable turnover to ensure it’s accurate and not miscalculated. Importantly, you also have to ensure you have no outstanding tax and administrative penalties in your account.

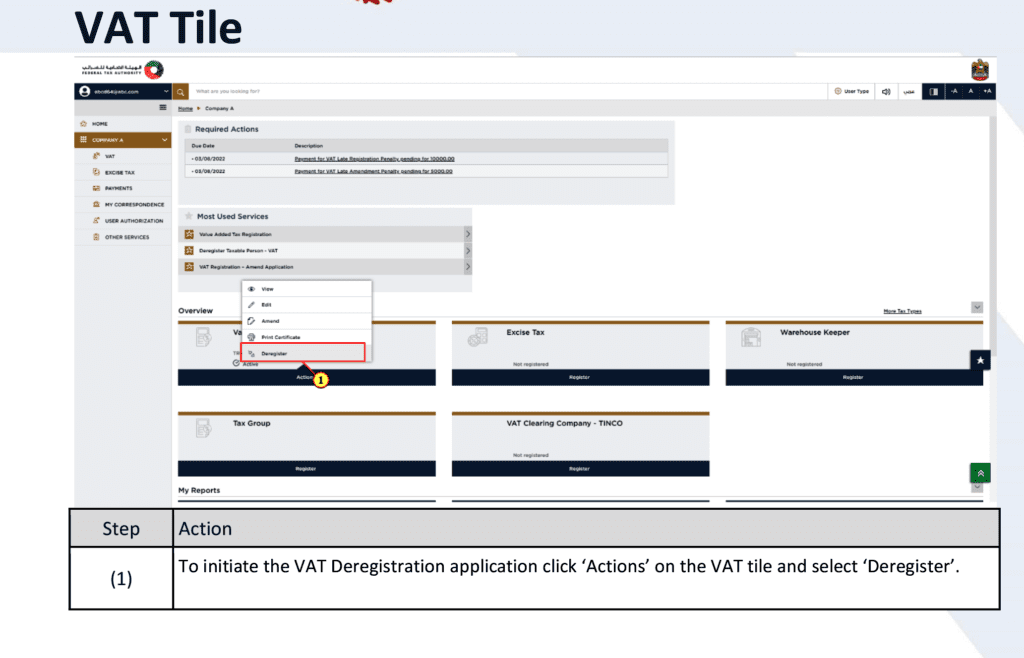

Here’s an overview of how businesses can request for cancel the VAT registration:

- Step 1: Prepare your documents: Before starting the application process, determine your eligibility based on voluntary or mandatory criteria for deregistration (e.g., turnover thresholds, and cessation of taxable activities). Once you ascertain your eligibility for VAT deregistration, gather all the necessary documents, including FTA tax registration details, financial statements, and reasons for deregistration of VAT.

- Step 2: Visit the online submission portal: Next, access the EmaraTax portal and navigate to the VAT section. Then log in using valid credentials (e.g., TRN and password) associated with the registered VAT account.

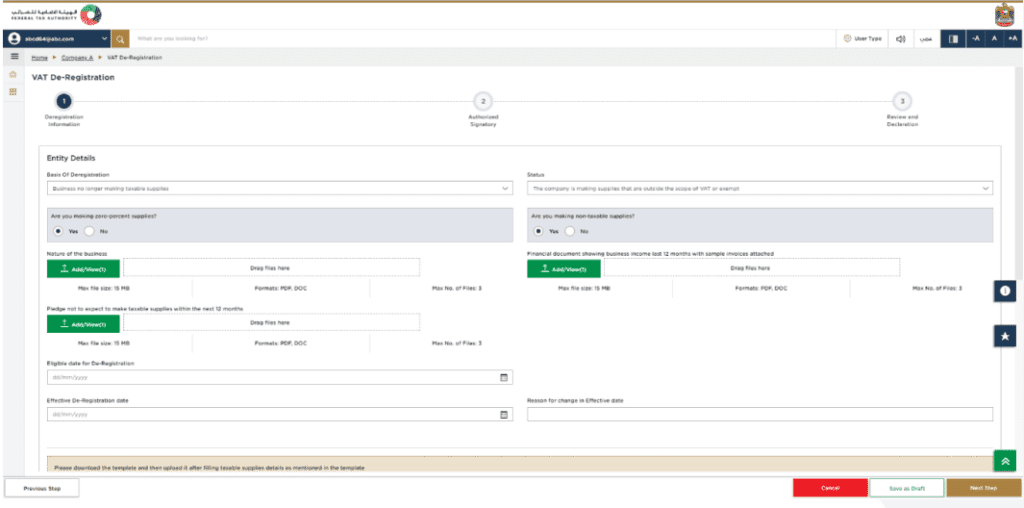

- Step 3: Submit the VAT Deregistration form: Once you’ve entered all your valid credentials, proceed to fill out the deregistration application form VAT online. Ensure that all information provided regarding the reason for deregistration and supporting documentation is accurate and complete.

- Step 4: Await FTA’s Approval: After you submit the application, the FTA carefully reviews both the application and all supporting documents. If everything meets the requirements and the documentation is deemed satisfactory, the FTA will approve your deregistration request.

- Step 5: Receive notification: Upon reviewing your application, the FTA will notify you of the deregistration approval either via email or through the online portal. It’s important to note that the effective date of deregistration is usually the end of the tax period in which your application was approved.

- Step 6: Fulfil all post-deregistration obligations: After receiving confirmation of your approval, you must fulfill any remaining tax obligations, which include filing the final tax return and settling any outstanding payments. Additionally, it is essential to maintain records under UAE Federal Tax Authority (FTA) tax regulations for the specified retention period.

Time Frame for UAE VAT De-registration

As a taxable person in the UAE, it is crucial to apply for VAT deregistration within 20 business days from the cessation of activities related to VAT supplies. This timeline ensures compliance with Federal Tax Authority (FTA) regulations and facilitates the timely processing of your deregistration request. Prompt action helps avoid potential penalties and ensures a smooth transition out of VAT obligations for your business.

Re Register for VAT After Deregistration

Wondering “Can I register for VAT after deregistration”? Yes, businesses in the UAE can re-register for VAT after deregistration, but it’s essential to meet the Federal Tax Authority (FTA) criteria. Whether you need a VAT deregistration letter to confirm your status or are considering re-registering with the FTA, understanding the process is key for smooth compliance. At Tulpar Global Taxation, we help businesses navigate the VAT deregistration and re-registration process efficiently, ensuring your VAT obligations are met without penalties. Stay ahead of the game and ensure your business is fully compliant with the FTA’s 2026 VAT guidelines.

How Can Tulpar Global Taxation Help You in the Deregistration Process?

Tulpar Global Taxation specializes in providing seamless VAT deregistration services in the UAE. With their expert services of VAT, they guide businesses through the complexities of the deregistration process, ensuring compliance with all necessary regulations. Businesses that are taxable persons and wish to claim input VAT may request for VAT cancellation when they no longer meet the deregistration conditions. This is particularly relevant for those whose taxable supplies have fallen below the mandatory registration threshold, or if the company is undergoing liquidation. If a business’s status of VAT registration has not been maintained correctly, the VAT cancellation process can help mitigate risks.

Tulpar Global Taxation meticulously manages the submission of the cancellation application, ensuring that all documentation, including the company liquidation letter, is complete and accurate. If the date of deregistration is more than 20 business days from the decision to deregister, it may result in a late VAT deregistration penalty of AED. Handling the entire application process, including online form completion and submission to the Federal Tax Authority (FTA), Tulpar Global Taxation acts as a reliable liaison. They maintain clear communication with the FTA, addressing any queries and ensuring that the application is approved by the FTA. Their commitment to compliance with UAE tax laws minimizes risks and ensures that businesses fulfill all necessary obligations during and after the deregistration of VAT.

The team’s efficient and supportive approach aims to streamline deregistration for VAT, allowing businesses to transition out of VAT obligations smoothly and confidently, especially when their taxable activities are less than the voluntary registration threshold or if 12 months is less since their initial registration.

FAQs:

VAT deregistration is the formal process of cancelling a business’s VAT registration with the Federal Tax Authority (FTA). It applies when a business no longer meets VAT registration requirements. Proper deregistration ensures the business is not exposed to future penalties.

A business should apply for VAT deregistration when it stops making taxable supplies or its taxable turnover falls below the voluntary registration threshold. Deregistration must be requested within the timeframe specified by the FTA. Delays can result in administrative penalties.

VAT deregistration can be mandatory or voluntary, depending on the situation. It is mandatory if the business no longer meets registration criteria. Voluntary deregistration may apply if turnover drops below the voluntary threshold.

Businesses must apply for VAT deregistration within 20 business days of becoming eligible. Missing this deadline can lead to FTA penalties. Timely action is critical in 2026 due to stricter enforcement.

The FTA may require financial statements, final VAT returns, proof of business closure (if applicable), and supporting documents. All VAT liabilities must be settled before deregistration is approved. Proper documentation speeds up approval.

Yes, a final VAT return must be filed before VAT deregistration is completed. This return covers all taxable supplies and adjustments up to the deregistration date. Any VAT payable must be cleared in full.

Yes, the FTA may reject the request if liabilities are unpaid, documents are missing, or eligibility conditions are not met. Incorrect applications often result in delays. Professional review reduces rejection risk.

Once approved, the business must stop charging VAT and remove VAT details from invoices. VAT records must still be retained for the legally required period. Deregistration does not remove past compliance obligations.

Common mistakes include missing deadlines, failing to submit the final VAT return, and assuming business inactivity removes VAT obligations. These errors often lead to penalties or rejected applications. Careful handling is essential.

Professional VAT advisors help assess eligibility, prepare documentation, file final returns, and manage FTA communication. Working with Tulpar Global Taxation ensures smooth VAT deregistration and full compliance.