Bookkeeping Firm in Dubai

Table of Contents

Related Articles

OFAC & AML: How to Remove a Company from the OFAC Sanction List

Excise Product Registration in the UAE – 2026

Let's Talk

Sign Up For Free Consultation

Bookkeeping Firm

At Tulpar Global Taxation, we understand that every business is unique. That’s why we offer tailored bookkeeping solutions designed to meet the diverse needs of Dubai’s dynamic market. From maintaining precise records to generating insightful financial reports, our team uses cutting-edge technology to deliver error-free results. More importantly, our services extend beyond the basics: whether it’s VAT compliance, payroll management, or financial forecasting, we help you make informed decisions that drive growth. Partnering with Tulpar means gaining a team of experienced professionals who prioritize accuracy, confidentiality, and efficiency.

Outsourcing your bookkeeping to a firm like Tulpar Global Taxation isn’t just a strategic decision—it’s a competitive advantage. With local expertise and a global perspective, we bridge the gap between compliance and innovation, ensuring your financial processes align seamlessly with Dubai’s regulatory framework. Ready to streamline your operations? Contact Tulpar Global Taxation Services today to experience the difference a dedicated bookkeeping partner can make in transforming your business.

Why Dubai Businesses Need Expert Bookkeeping Services

In today’s fast-paced business environment, accurate financial management is vital for success, especially in a competitive market like Dubai. Expert bookkeeping services not only ensure compliance with local regulations but also play a crucial role in streamlining operations and minimizing errors. Whether you’re managing day-to-day transactions or preparing for an audit, leveraging professional expertise can significantly enhance your business’s financial health.

Avoid Costly Errors with Professional Bookkeeping

The complexities of financial reporting and tax regulations in Dubai demand precision. Mistakes in bookkeeping can lead to costly penalties, errors in tax filings, and missed opportunities for optimization. Professional bookkeeping services, such as those offered by Tulpar Global Taxation Services, ensure that your financial records are accurate and up-to-date. By maintaining detailed, error-free records, businesses avoid the risks associated with incorrect financial data, which could otherwise lead to expensive legal and financial repercussions.

Additionally, professionals use advanced accounting software, automating tasks and reducing the chances of human error. This level of accuracy not only keeps you compliant but also provides clear insights into your business’s financial standing, helping you make informed decisions.

Streamline Compliance with UAE Financial Regulations

Navigating the complex landscape of UAE financial regulations, including VAT and corporate taxes, is a challenge for many businesses. In Dubai, compliance is non-negotiable, and failure to meet the requirements can result in substantial fines and legal issues. Expert bookkeeping services ensure that your business adheres to local tax laws, including VAT reporting, timely filing, and maintaining accurate records for audits.

By outsourcing your bookkeeping needs to professionals, businesses can streamline their operations and free up valuable time. This allows business owners to focus on growth while experts handle the compliance side of financial management. With Tulpar Global Taxation Services, businesses gain not only compliance but also strategic financial planning, which enhances their overall efficiency and sustainability in the market.

In conclusion, investing in expert bookkeeping services is a strategic move for businesses in Dubai. It helps prevent costly mistakes, ensures compliance with UAE financial regulations, and provides essential insights into your financial performance. Tulpar Global Taxation Services is committed to offering tailored solutions that support your business’s success in Dubai’s competitive landscape.

Tulpar Global Taxation - Your Trusted Bookkeeping Partner

In today’s competitive business environment, efficient financial management is crucial for maintaining operational success. Tulpar Global Taxation stands as a trusted partner for businesses of all sizes, offering tailored bookkeeping services designed to streamline financial processes and ensure compliance with tax regulations. Whether you’re a small or medium-sized enterprise (SME) or a large corporation, Tulpar’s expert team provides the necessary expertise to handle your business’s financial health effectively.

Tailored Solutions for SMEs and Large Enterprises

Tulpar Global Taxation recognizes that each business has unique financial needs. For SMEs, staying compliant with tax laws and managing cash flow can be particularly challenging. Tulpar offers affordable, scalable bookkeeping services that ensure financial operations remain smooth, allowing businesses to focus on growth while meeting regulatory requirements. For larger enterprises, Tulpar offers more complex services, including financial strategy planning, audit preparation, and compliance assurance, ensuring that all operations, from daily transactions to annual audits, are handled with precision.

The flexibility of Tulpar’s services means businesses can easily adjust their financial support as they scale, gaining access to professional accounting and financial reporting without the overhead of an in-house accounting department. By opting for Tulpar, businesses ensure their financial records are not only up-to-date but also aligned with local taxation laws, such as VAT and corporate tax requirements.

How Tulpar Ensures Transparency in Financial Operations

Transparency is vital to building trust with stakeholders, and Tulpar Global Taxation prioritizes clear and consistent financial reporting. The company’s approach includes meticulous tracking of all income and expenses, ensuring that businesses have accurate records at all times. Tulpar delivers timely, detailed reports on profit and loss, balance sheets, and cash flow, enabling clients to make informed decisions based on reliable financial data.

Additionally, Tulpar’s commitment to regulatory compliance ensures that all financial activities are fully aligned with UAE tax laws, including VAT filings and corporate tax regulations. This approach not only reduces the risk of legal penalties but also prepares businesses for tax audits with organized and easily accessible financial records.

By partnering with Tulpar Global Taxation, businesses can be confident that their financial operations are being handled with the utmost care, precision, and transparency, empowering them to navigate the complex financial landscape with ease.

Benefits of Outsourcing Bookkeeping Services in Dubai

Outsourcing bookkeeping services in Dubai offers a range of significant advantages for businesses, whether they are small enterprises or large corporations. By leveraging external experts for financial management, companies can streamline their operations, reduce costs, and ensure regulatory compliance. Here’s how outsourcing can benefit your business:

Save Time and Focus on Growth

Outsourcing bookkeeping allows businesses to save valuable time that would otherwise be spent on managing daily financial tasks. By handing over the responsibility of tracking transactions, managing accounts, and preparing financial reports to experienced professionals like Tulpar Global Taxation, business owners and managers can focus on what matters most—growing the business. This shift allows companies to allocate more resources to strategic areas like marketing, product development, or customer relations, fostering long-term growth.

Reduce Overheads and Improve Accuracy

Hiring a full-time in-house bookkeeping team can be costly, especially for SMEs. Outsourcing bookkeeping eliminates the need for recruitment, training, and employee benefits, significantly reducing overhead costs. Moreover, professional bookkeeping firms like Tulpar have experienced teams skilled in managing complex financial systems, ensuring higher accuracy in financial reporting. This reduces the likelihood of errors, late filings, or compliance issues, which can otherwise lead to costly penalties.

The Role of Advanced Tools in Modern Bookkeeping

The rapid evolution of technology has drastically transformed the bookkeeping landscape, making it more efficient, accurate, and secure. Today, modern tools and software are integral to financial operations, streamlining tasks such as transaction tracking, invoicing, and financial reporting. These tools leverage automation to handle repetitive tasks, significantly reducing the risk of human error while speeding up the entire process. For businesses in Dubai, adopting cutting-edge technology is not just a convenience but a necessity, especially in an environment where regulatory compliance and financial transparency are paramount.

Furthermore, advanced software systems provide real-time insights into financial data, making it easier for businesses to stay on top of their financial health and make informed decisions. With integrated cloud-based solutions, bookkeeping can now be done remotely, offering unparalleled flexibility and efficiency. In addition, automation minimizes manual entry, ensuring data consistency and improving accuracy across all financial records. As businesses face increasing pressure to stay compliant with local tax regulations, such as VAT in the UAE, technology becomes a vital tool in ensuring accuracy and timeliness, which directly impacts a company’s bottom line.

Moreover, these advanced systems also include robust security features, which are essential for protecting sensitive financial data from breaches or unauthorized access. Data encryption, secure cloud storage, and multi-factor authentication are just a few of the advanced security measures that modern bookkeeping tools employ to ensure confidentiality.This combination of efficiency, accuracy, and security through technology makes it clear why businesses are increasingly outsourcing their bookkeeping to firms like Tulpar Global Taxation.

Leveraging Automation for Error-Free Accounting

One of the major advantages of using advanced bookkeeping tools is automation. By integrating sophisticated software, businesses can automate key processes such as invoice generation, expense tracking, and reconciliations. This automation minimizes human error, ensuring that financial data is accurate and up-to-date. For example, Tulpar Global Taxation uses leading tools that automate key accounting tasks, allowing for faster and more efficient processing of transactions, making bookkeeping virtually error-free.

Ensuring Secure and Confidential Data Management

In today’s digital age, data security is a primary concern for businesses. Outsourcing bookkeeping to firms like Tulpar Global Taxation provides an added layer of security through the use of advanced encryption and data protection systems. These systems ensure that sensitive financial information, such as business transactions and tax filings, is securely stored and only accessible to authorized personnel. By leveraging these tools, businesses can avoid the risk of data breaches while maintaining compliance with UAE regulations on data confidentiality.

Through automation and secure data management, businesses can streamline their financial operations while safeguarding sensitive information, making outsourcing bookkeeping a wise decision for companies in Dubai.

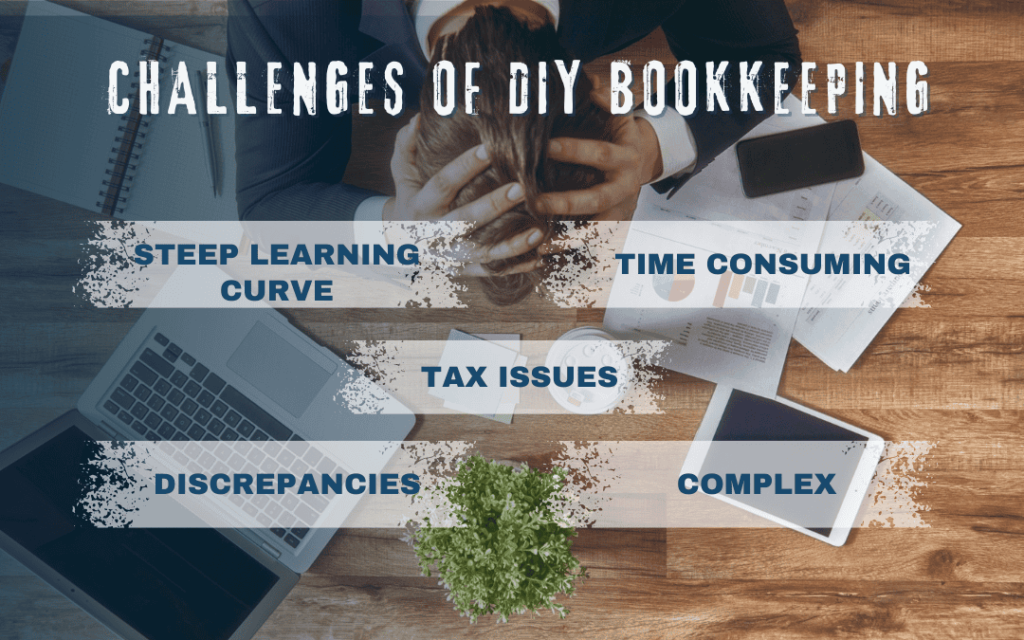

Challenges of DIY Bookkeeping in Dubai

While handling bookkeeping in-house may seem like a cost-effective solution, it often leads to a series of challenges that can affect the efficiency and financial health of your business in Dubai. The rapidly changing regulatory landscape and the need for accurate, up-to-date financial records make DIY bookkeeping a risky approach for many entrepreneurs.

The Hidden Costs of In-House Accounting

Many businesses underestimate the true costs of managing bookkeeping in-house. First, there are the direct costs, such as hiring full-time accounting staff or purchasing expensive software. Then, there are indirect costs, such as the time spent by business owners or managers on financial tasks instead of focusing on strategic growth initiatives. Additionally, bookkeeping requires specialized knowledge to comply with UAE’s tax laws and VAT regulations, and without proper expertise, businesses risk errors, missed filings, or penalties. These hidden costs can quickly add up, making in-house accounting a less efficient solution.

How Outsourcing Solves Resource Constraints

Outsourcing bookkeeping to a professional firm like Tulpar Global Taxation offers an efficient solution to the resource constraints many businesses face. With limited internal resources, SMEs often struggle to maintain accurate financial records or keep up with regulatory changes. Outsourcing allows businesses to tap into expert knowledge, using advanced tools and technology to manage accounting tasks effectively. This reduces the workload for internal teams, enabling them to focus on the core aspects of the business while leaving financial management to specialists.

How to Choose the Right Bookkeeping Firm

Selecting the right bookkeeping firm is a critical decision for any business in Dubai. With the complexity of local tax laws, VAT regulations, and the growing need for accuracy and transparency in financial reporting, ensuring that your financial records are managed properly is essential for avoiding costly mistakes and maintaining compliance with the law. The right partner will not only help you navigate the intricacies of financial management but will also provide strategic insights that can optimize your operations and support growth.

When choosing a bookkeeping firm, there are several key factors to consider:

- Expertise in Local Regulations: The UAE’s business and tax environment is unique, with regulations such as VAT and corporate tax that can be complex and subject to frequent changes. The right firm should have a deep understanding of these regulations, ensuring that your business stays compliant and avoids potential fines or penalties. Firms like Tulpar Global Taxation specialize in local tax laws, providing expert guidance on how to meet regulatory requirements seamlessly.

- Range of Services Offered: Bookkeeping is just one aspect of a broader set of financial services. Look for a firm that offers a comprehensive range of solutions, such as VAT advisory, payroll management, financial reporting, and audit support. This ensures that you have a one-stop partner who can handle all aspects of your financial operations and provide holistic advice on minimizing tax liabilities and optimizing cash flow.

- Technology and Automation: Modern bookkeeping firms leverage advanced tools and software to ensure that financial records are accurate, up-to-date, and accessible. When evaluating potential firms, ask about the tools they use for automating processes like invoicing, transaction recording, and financial reporting. Automation helps reduce human errors, speed up financial processes, and provide real-time insights into your financial health

- Reputation and Client Reviews: It’s important to choose a firm with a proven track record of delivering quality services. Look for testimonials, case studies, or references from businesses in similar industries to gauge their expertise and the level of service you can expect. A reputable firm like Tulpar Global Taxation has a solid reputation for providing top-notch bookkeeping and financial advisory services, ensuring clients receive reliable and accurate financial management.

By keeping these factors in mind and asking the right questions, you can confidently select a bookkeeping firm that will help ensure the accuracy of your financial data, keep you compliant with UAE regulations, and ultimately support the continued growth of your business.

Key Questions to Ask Your Service Provider

When evaluating bookkeeping firms, it’s crucial to ask the right questions to ensure they can meet your business needs. Some key questions include:

- What experience do you have with businesses in my industry?

- How do you ensure compliance with UAE tax laws and VAT regulations?

- What software tools do you use, and how do they benefit my business?

- How will you handle confidential financial information, and what security measures do you have in place?

- Can you provide references or case studies of businesses similar to mine?

These questions will help you assess whether the firm has the necessary expertise and resources to manage your bookkeeping efficiently and accurately.

Why Tulpar Global Stands Out in Dubai’s Market

Tulpar Global Taxation stands out as a top bookkeeping service provider in Dubai due to its deep expertise in local tax laws, comprehensive range of services, and commitment to using the latest technology to streamline financial operations. With years of experience in the UAE market, Tulpar understands the complexities businesses face when it comes to VAT compliance, corporate tax, and bookkeeping management. Their use of cutting-edge automation tools ensures error-free accounting, and their focus on transparent, secure financial reporting helps businesses maintain compliance with ease.

Additional Services Offered by Bookkeeping Firms

In addition to core bookkeeping functions, many firms like Tulpar Global Taxation offer a wide range of complementary services that can significantly enhance your business’s financial management. These services go beyond basic record-keeping and provide comprehensive solutions to ensure all aspects of your financial operations are handled with precision and in compliance with UAE’s strict tax laws. By leveraging these additional services, businesses can improve operational efficiency, reduce the risk of financial mismanagement, and maintain seamless compliance with ever-evolving regulations.

One of the most important services offered by leading firms like Tulpar is VAT advisory, which is crucial for businesses in Dubai to remain compliant with the UAE’s VAT laws. Given the complexity and frequent updates to VAT regulations, expert guidance can help businesses avoid costly errors in VAT returns, manage exemptions, and optimize tax liabilities. Tulpar’s VAT advisory service ensures that businesses understand and implement the most current tax laws, keeping them ahead of compliance challenges and protecting them from penalties.

Another vital service provided is payroll management, which is essential for businesses that employ staff. Managing payroll accurately and efficiently is not only a legal requirement but also crucial for employee satisfaction and retention. Outsourcing payroll to a trusted firm like Tulpar ensures that wages, deductions, and benefits are processed correctly and in compliance with local labor laws, saving businesses the time and effort of handling this complex task in-house. Additionally, it ensures that businesses are prepared for audits and can provide accurate reports when required by the tax authorities.

Lastly, many firms offer financial reporting services, which include the preparation of detailed financial statements such as profit and loss accounts, balance sheets, and cash flow reports. These reports are essential for businesses to track their financial performance, make informed decisions, and prepare for tax filings or audits. Outsourcing financial reporting to experts ensures that these documents are accurate, compliant, and reflective of the true financial position of the business.By integrating these complementary services into their financial strategy, businesses not only gain peace of mind but also streamline their operations, reduce overhead costs, and focus on growth—all while ensuring full compliance with UAE tax and business regulations.

VAT Advisory for Seamless Compliance

For businesses in Dubai, maintaining compliance with the UAE’s VAT laws is critical. Bookkeeping firms such as Tulpar Global Taxation provide VAT advisory services that ensure your business adheres to the local VAT regulations. These services include accurate VAT filing, assistance with VAT exemptions, and guidance on tax-saving strategies. By outsourcing VAT advisory, you can avoid costly mistakes and minimize the risk of penalties.

Payroll Management and Financial Reporting

Managing payroll and ensuring timely and accurate financial reporting is a complex task that requires attention to detail. Many bookkeeping firms, including Tulpar, offer payroll management services that ensure employees are paid correctly and on time, while also handling deductions and benefits as per UAE regulations. Financial reporting services provided by Tulpar include preparing profit and loss statements, balance sheets, and other financial documents, which help businesses make informed decisions and maintain transparency.

By outsourcing these services, businesses not only streamline their operations but also ensure they comply with all local regulations, helping to avoid costly penalties and improve financial visibility.

Ready to Simplify Your Finances?

Managing your business’s finances doesn’t have to be complex or time-consuming. With the right support, you can streamline your financial operations, ensure compliance with local regulations, and free up time to focus on growing your business. Whether you need basic bookkeeping or more comprehensive financial services, Tulpar Global Taxation offers the expertise and tools to simplify your finances and keep you on track.

Contact Tulpar Global Taxation Today

If you’re ready to take control of your business finances, Tulpar Global Taxation is here to help. Their experienced team specializes in a wide range of services, from bookkeeping to VAT advisory, payroll management, and more. With a deep understanding of local tax laws and the latest financial tools, Tulpar provides tailored solutions that meet your specific needs. Reach out today to learn how they can support your business’s financial health and ensure compliance with UAE regulations.

Explore Customizable Packages for Your Needs

Tulpar Global Taxation understands that every business is unique, which is why they offer customizable service packages designed to fit your specific requirements. Whether you’re an SME or a large corporation, you can select from a range of services that align with your business’s financial goals and budget. These flexible packages ensure you get the right level of support without paying for unnecessary services. Contact Tulpar to explore their customizable options and find the perfect solution for your business’s bookkeeping and financial management needs.

A bookkeeping firm manages your business’s financial records, including sales, purchases, payments, receipts, and general ledgers. Accurate bookkeeping ensures clear financial insight, smooth VAT and Corporate Tax compliance, and reliable reporting. This foundational service supports business growth and audit readiness.

Professional bookkeeping helps companies avoid costly mistakes in VAT returns, financial reporting, and tax filings. As UAE tax frameworks evolve—especially with VAT and Corporate Tax in place—organized records are essential for compliance, audits, and strategic planning. Strong bookkeeping strengthens financial control.

All businesses, from startups to large enterprises, benefit from professional bookkeeping. E-commerce, trading, services, Free Zone companies, and multinational entities all require accurate record-keeping. Even small operations find value in streamlined books that support growth and compliance.

Typical services include daily transaction recording, bank reconciliation, ledger maintenance, accounts payable/receivable tracking, financial statement preparation, and supporting VAT/Corporate Tax filings. Customized packages help align bookkeeping with specific industry needs.

Accurate bookkeeping ensures that all taxable supplies, input VAT, and transactions are correctly recorded. This makes VAT return preparation easier and reduces the risk of errors that could lead to FTA audits or penalties. Organized books enable timely and accurate VAT returns.

Yes. Corporate Tax calculations rely on accurate financial records. Bookkeeping ensures revenue, expenses, and adjustments are properly documented, which is essential for correct tax liability calculations and audit readiness under UAE Corporate Tax law.

Absolutely. Bookkeeping firms organize and maintain records required for internal and external audits. They prepare supporting documentation, reconcile accounts, and ensure books show a true and fair view of financial performance—making audits more efficient and less stressful.

Outsourcing bookkeeping to a firm offers expertise, reduces overhead, and ensures accuracy—especially when regulatory requirements change. Many Dubai businesses find that outsourcing to specialists like Tulpar Global Taxation delivers both compliance strength and operational efficiency.

Bookkeeping firms typically use leading accounting platforms like QuickBooks, Xero, Zoho Books, and Oracle NetSuite. The choice depends on client needs, transaction volume, and reporting requirements. Professional firms tailor software to match your business structure.

Look for a firm with UAE experience, strong compliance knowledge (VAT, Corporate Tax, ESR), and transparent pricing. Certification, industry expertise, and client testimonials also matter. Firms that integrate bookkeeping with broader tax advisory (like Tulpar Global Taxation) provide strategic value.