Tax Residency Certificate in UAE (TRC) - 2026

A Tax Residency Certificate (TRC) in UAE for 2026 proves your tax residency status, essential for tax treaty benefits and compliance. Our expert consultants guide you through eligibility, documentation, and application processes to secure your TRC efficiently.

Table of Contents

Related Articles

Excise Product Registration in the UAE – 2026

Sugar Tax Reform Will Crush Small UAE Drink Brands

Let's Talk

Sign Up For Free Consultation

UAE Tax Residency Certificate

The Tax Residency Certificate (TRC) is a game-changer for individuals and businesses looking to optimize their tax position and unlock international tax benefits. Issued by the FTA, this official document proves your tax residency status in the UAE, helping you avoid double taxation and secure treaty advantages with over 100 countries.

Whether you’re an expatriate, an entrepreneur, or a multinational company, obtaining a tax residency certificate UAE ensures financial flexibility, legal compliance, and enhanced global credibility. With the United Arab Emirate’s business-friendly tax policies, securing your tax resident certificate UAE is essential for smoother financial transactions, business expansions, and tax efficiency.

Applying for a tax residency certificate UAE is now easier than ever, thanks to the FTA eServices and EmaraTax login platforms. The process involves verifying eligibility, submitting key documents like a residence declaration form, proof of place of residence in U.A.E, and bank statements, followed by online application submission. The tax residence certificate UAE cost varies typically AED 1,000 for individuals and AED 10,000 for businesses, with a validity period of one year.

To ensure a smooth process, avoid common mistakes such as missing paperwork or incorrect details in your controlling person tax residency self certification form. With the right approach, securing your tax residency certificate Dubai or tax residency certificate Abu Dhabi is a seamless process that unlocks financial and legal advantages in the U.A.E.

What is a Tax Residency Certificate (TRC) and Why Do You Need It?

A Tax Residence Certificate in UAE (TRC) is a crucial document for individuals and businesses looking to establish their residency for tax purposes. Whether you’re an entrepreneur, investor, or multinational corporation, securing a TRC can help you optimize your tax liabilities and comply with international tax laws. In this article, we’ll explore the TRC meaning, its significance, and how it differs from other tax residency documents like the Certificate of Fiscal Residence.

A Tax Residency Certificate is an official document issued by a country’s tax authority, proving your tax residency status. It’s your golden ticket to claiming tax treaty benefits, avoiding dual taxation, and ensuring compliance with international tax laws. For NRIs, U.A.E residents, and global entrepreneurs, a TRC isn’t just paperwork, it’s a strategic tool to optimize your finances. Over 90 countries have Double Tax Avoidance Agreement, and a TRC is your proof to leverage them!

In the UAE, businesses and individuals must navigate various tax and residency requirements to ensure compliance. The TIN number UAE and tax identification number for U.A.E residents are crucial for taxation purposes. Companies must obtain a certificate of incorporation UAE or an incorporation certificate UAE, with some requiring a certificate of incorporation U.A.E sample for reference. Understanding TRC is essential for those seeking treaty resident status to benefit from DTAs. Dubai tax regulations apply to businesses, and U.A.E residents must be aware of their residence status for tax obligations. The entry exit report UAE helps determine the country of tax residency meaning, a critical factor for Emirates residency and tax compliance.

TRC Meaning and Its Significance for Individuals and Businesses

A Tax Residency Certificate is an official document issued by the FTA in the UAE. It serves as residence proof that an individual is UAE tax resident and is eligible to benefit from the country’s DTTs with other nations.

Why is a TRC Important?

- Tax Benefits & Treaty Advantages: Many countries have DTAs that prevent individuals and businesses from being taxed twice on the same income. A TRC allows taxpayers to claim these benefits.

- Avoidance of Withholding Tax: Businesses conducting international transactions can use a TRC UAE Certificate to reduce or eliminate withholding taxes imposed by foreign jurisdictions.

- Compliance with International Tax Laws: Many regulatory authorities require proof of tax residency to prevent tax evasion and ensure compliance.

- Corporate Tax Planning: Companies use TRCs to establish their tax jurisdiction, ensuring lower tax burdens and smoother cross-border operations.

- For Individuals & Expats: A TRC can be essential for expatriates in the U.A.E. who wish to prove their tax residency in the UAE and avoid taxation in their home country.

Difference Between a Tax Residency Certificate UAE and a Certificate of Fiscal Residence

While both documents serve as proof of tax residency, they have key differences:

Feature | Tax Residency Certificate | Certificate of Fiscal Residence |

Issued by | Federal Tax Authority (FTA) | Issued by tax authorities of other countries |

Purpose | Used for UAE tax residency and accessing double tax agreements | Establishes tax residency in another country |

Eligibility | Individuals and businesses residing in the UAE for at least 183 – days (for individuals) | Residents of other countries who need to prove tax residency |

International Recognition | Accepted by jurisdictions with UAE DTTs | Accepted in respective countries |

How to Apply for a Tax Residency Certificate UAE?

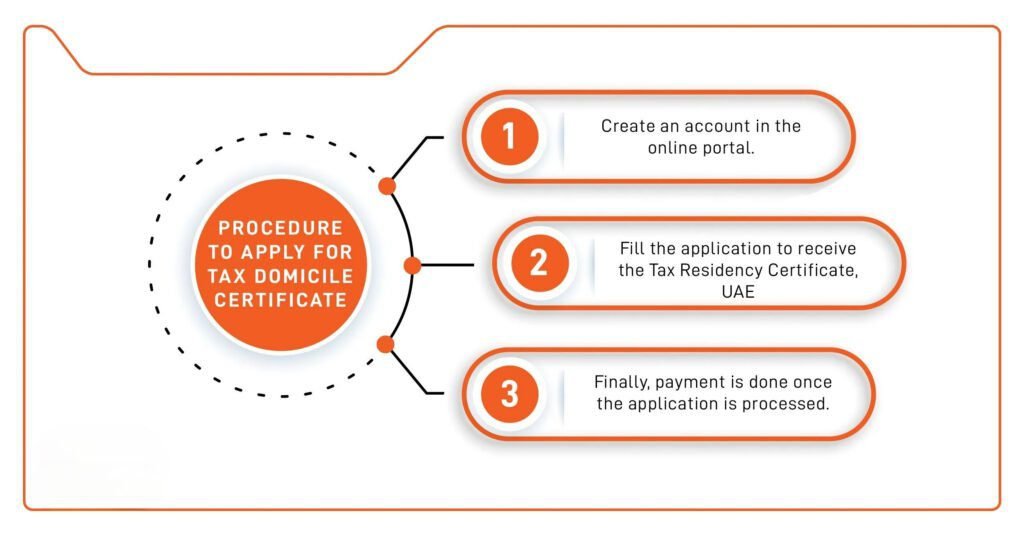

To obtain a Tax Residence Certificate in Dubai – U.A.E, applicants must use FTA eServices via the EmaraTax login platform. The process involves:

- Submitting proof of residency (Emirates ID, tenancy contract, passport, visa)

- Providing financial statements or salary certificates

- Paying the required fees to the FTA.

Unlock UAE Residency & Tax Benefits in 2026

Navigating the UAE’s residency and taxation system can be complex, but having the right information makes all the difference. Whether you need an entry and exit report UAE for visa compliance, a tax certificate UAE to confirm your country of tax residence, or a tax residency certificate UAE individual for global tax advantages, we’ve got you covered. Wondering about your UAE residency number or the UAE resident meaning? Looking for a UAE residence visa 180 days calculator to maintain your residency status?

From securing a Dubai permanent residence permit to obtaining a corporate tax certificate, we simplify the process. Even if you need a gift for someone living in Dxb or insights on the golden emirates employees provision services LLC, we provide expert guidance. Stay ahead with up-to-date tax and residency solutions, including your taxpayer identification number in UAE, tax identification number United Arab Emirates, and UAE permanent resident card.

Benefits of a Tax Residency Certificate

- Tax Savings: Slash withholding tax rates (e.g., from 30% to 10%).

- Global Mobility: Simplify cross-border investments and banking.

- Legal Protection: Shield yourself from tax disputes.

- Competitive Edge: U.A.E. firms gain trust in international markets.

UAE businesses with TRCs report 25% higher success in securing global contracts.

How to Get a Tax Residency Certificate in Dubai - UAE?

Your country of tax residency is the jurisdiction where you are legally obligated to pay taxes based on your residence, income, or business operations. This status directly influences your tax liabilities, exemptions, and obligations.

Factors That Determine Tax Residency:

- Physical Presence: Most countries, including the U.A.E, use the 183-day rule to determine residency.

- Permanent Home: Owning property in a country may contribute to tax residency.

- Center of Vital Interests: If your primary business and personal ties are in one country, it may be considered your tax residency.

- Legal and Corporate Registration: Companies must establish their tax residency based on their place of incorporation and management.

How Tax Residency Affects Individuals and Businesses:

- Individuals: Your tax residency affects which country has the right to tax your worldwide income.

- Businesses: A company’s tax residency determines whether it must pay corporate tax in the UAE or another jurisdiction.

A Tax Residence Certificate UAE is a powerful tool for reducing tax liabilities and ensuring compliance with international tax laws. Whether you’re an expat, business owner, or multinational corporation, securing a TRC through FTA eServices on EmaraTax login can provide significant tax advantages. Understanding TRC meaning, the differences between a Certificate of Fiscal Residence, and how tax residency impacts taxation will help you make informed financial decisions. If you’re considering applying for a tax residency certificate, consult with a tax expert or visit the Federal Tax Authority for more details.

Key Takeaways:

- TRC helps individuals and businesses benefit from double taxation agreements.

- It differs from a Certificate of Fiscal Residence based on jurisdiction.

- Your tax residency country determines your tax obligations worldwide.

Need assistance with obtaining your Tax Residency Certificate UAE? Visit EmaraTax login or consult with a tax expert today! At Tulpar Global Taxation, we specialize in helping individuals and businesses navigate international tax laws, secure their Tax Domicile Certificate UAE, and optimize their tax strategies. Contact us today for expert guidance on TRC Certificate Dubai.

Benefits of Obtaining a UAE Tax Residency Certificate

Obtaining a Tax Residency Certificate offers numerous advantages for individuals and businesses. It helps establish tax residency in United Arab Emirates, which is beneficial for claiming tax exemptions under double tax treaties with other countries, potentially reducing the tax burden. This certificate also allows individuals to access the U.A.E’s favorable tax environment, which includes no personal income tax. For businesses, it can facilitate smoother operations and compliance, especially when dealing with international trade or investment opportunities. Additionally, it enhances the credibility and financial standing of companies and individuals in the global market.

How a Tax Residency Certificate Helps in Avoiding Double Taxation

One of the most significant advantages of obtaining Tax Residency_Certificate is the ability to avoid dual taxation. By proving your tax residency, you can leverage the country’s extensive network of Double Taxation Avoidance Agreements (DTAAs) with over 80 countries. This means you’ll avoid being taxed twice on the same income—once in the U.A.E and again in your home country. The TRC ensures that the tax you pay in one jurisdiction is credited against the tax you owe in the other, helping you keep more of your earnings.

Tulpar Global Taxation offers expert advisory services on international tax laws and DTAAs, ensuring that you can fully capitalize on these benefits without the hassle.

Tax Residency Certificate for Companies vs. individuals – Key Differences

While both individuals and businesses can apply for a UAE Tax Residency Certificate, the process and requirements vary.

- For Individuals: The tax residency certificate proves that an individual spends a majority of the year (at least 183 – days) in the UAE. This is especially beneficial for those looking to avoid taxation in their home country or gain access to favorable tax agreements.

- For Companies: For businesses, the certificate proves that a company is incorporated and conducts its substantial activities in the UAE. This allows companies to benefit from various tax agreements and enjoy exemptions or reductions in tax rates in different jurisdictions.

Whether you’re an individual or a business, Tulpar Global Taxation helps tailor the application process to suit your specific needs, ensuring that you meet all the criteria and maximize the tax benefits available.

Why Proof of Residency is Essential for Financial and Legal Matters

Having a TRC Tax Residency Certificate is crucial for several financial and legal matters. This includes:

- Banking and Investment: Banks and financial institutions often require proof of tax residency before granting services or opening accounts.

- Inheritance and Estate Planning: If you’re planning to pass on assets to heirs, your tax residency status can impact the tax obligations they face.

- International Business: If you’re doing business globally, a TRC allows your company to avoid dual taxation, ensuring better cash flow and tax efficiency.

Tulpar Global Taxation can assist you with navigating these complex financial and legal matters, ensuring that your TRC application aligns with your broader goals.

How to Get a Tax Residency Certificate in the UAE – Step-by-Step Guide

Obtaining a Tax Residency Certificate is a straightforward process, but it’s essential to follow the correct steps to ensure a successful application. If you are searching “how to get tax residency certificate in dubai – UAE. Don’t Worry! Thanks to the U.A.E. commitment to digitization, you can easily apply for your TRC online through the EmaraTax portal. Here’s how:

- Visit the EmaraTax Website: Head to the official EmaraTax portal (https://www.emaratat.ae).

- Login to Your Account: Use your registered credentials to log in. If you don’t have an account, you’ll need to create one by providing basic information about yourself or your business.

- Navigate to the TRC Application Section: Once logged in, find the “Tax Residency Certificate” application option under the “eServices” tab.

- Fill in the Application Form: Provide your personal or business details, along with information regarding your UAE residency status.

- Submit Your Documents: Upload the necessary documents (more on that below). Double-check that everything is correct before submitting.

- Review & Submit: After filling out the application and uploading your documents, submit your application for review. You’ll receive a confirmation email upon successful submission.

FTA eServices – How the Federal Tax Authority Processes TRC Applications

The Federal Tax Authority (FTA) is responsible for processing all TRC applications. Here’s what you can expect:

- Document Review: The FTA will verify your submitted documents to confirm that you meet the eligibility requirements.

- Approval Process: If everything is in order, the FTA will approve your application, and you’ll receive your TRC digitally, typically within a few days.

- Fees: Be aware that there may be nominal fees associated with your TRC application, depending on the nature of your request (individual or corporate).

With Tulpar Global Taxation’s guidance, you can simplify this process and ensure that all required documents are in order to avoid delays.

Required Documents for Tax Residency Certificate in UAE

To ensure your application goes smoothly, it’s essential to provide the correct documents. Here’s what you’ll need:

For Individuals: Documents required for tax residency certificate individuals are;

- Passport copy

- U.A.E. visa or Emirates ID copy

- Proof of residence (utility bills, rental agreements, etc.)

- Proof of income or employment (salary slips, bank statements, etc.)

- A completed application form

For Companies:

- Trade license or commercial registration certificate

- Proof of substantial business activities in the UAE

- Copy of the company’s incorporation documents

- Financial statements or tax filings (if applicable)

Make sure all documents are valid, clear, and up to date to avoid delays in the processing of your TRC. Tulpar Global Taxation can help ensure your documents meet the FTA’s requirements.

Why You Need a UAE Tax Residency Certificate TRC Today

Whether you are an individual looking to streamline your financial obligations or a company seeking to maximize global business opportunities, the UAE Tax Residency Certificate is your gateway to numerous advantages. From avoiding dual taxation to simplifying complex legal matters, the TRC is an essential tool in your financial toolkit. Follow our easy step-by-step guide to secure your certificate and unlock the full potential of the UAE’s tax advantages. Don’t wait—take the first step toward securing your tax residency in U.A.E today!

For expert assistance throughout the process, Tulpar Global Taxation is here to help. Our experienced team ensures your TRC application is smooth and efficient, helping you navigate the complexities of international tax laws and compliance. Contact us today to get started!

Tax Residency Certificate UAE Requirements – Who is Eligible?

To be eligible for a Tax Residency Certificate, individuals and businesses must meet certain criteria. For individuals, they must have lived in the UAE for at least 183 – days in a calendar year or be employed by a UAE-based company. The individual must also maintain a permanent residence in the UAE and have their primary economic interests there.

For businesses, they must be registered and operating in the U.A.E, with proof of a physical presence, such as an office or facility, and meet other operational and financial requirements. Both entities must demonstrate that they are not tax residents of any other country during the requested period.

UAE Tax Residency Certificate for Individuals – Proof of Address, Bank Statements, and More

To be eligible for a UAE Tax Residency Certificate as an individual, you must prove that you meet the residency requirements. The primary criteria for individuals are:

- Physical Presence: You must reside in the U.A.E for a minimum of 183 – days within a 12-month period.

- Proof of Residency: Provide documents such as utility bills (water, electricity, etc.), a rental agreement, or a property ownership certificate to confirm your address in the U.A.E.

- Bank Statements: Recent bank statements showing activity in U.A.E accounts can further demonstrate your connection to the country.

- Visa/Emirates ID: A copy of your valid U.A.E visa and Emirates ID is essential as it proves your legal status in the country.

For a smooth application, ensure that all your documents are up to date and align with the residency requirements. Tulpar Global Taxation provides expert guidance to help you compile the necessary paperwork and avoid any complications.

Tax Residency Certificate UAE for Companies – Business License, Financial Statements, and Eligibility Criteria

For companies, the eligibility criteria for obtaining a UAE Tax Residency Certificate include:

- Business License: The company must be registered and hold a valid trade or business license issued by a UAE Free Zone or a mainland authority.

- Financial Statements: You must provide up-to-date financial statements that show the company’s activities in the U.A.E. These should include income, expenses, and any tax filings, if applicable.

- Substantial Business Activities: The company must demonstrate that it has substantial business activities in the U.A.E. This could include staff operations, offices, assets, or production.

Having a Tax Residency Certificate UAE for company can provide substantial tax benefits, such as access to DTAAs with other countries. Tulpar Global Taxation can help you ensure that your business meets all requirements for a successful application.

Understanding the Residence Declaration Form and Its Role in the Application

The Residence Declaration Form is a mandatory document in the application process for both individuals and companies. This form confirms your tax residency status in the UAE and requires you to declare the number of days spent in the country (for individuals) or demonstrate your business activities (for companies). Ensure this form is filled out accurately, as any discrepancies can lead to delays in processing.

UAE Tax Residency Certificate Costs and Validity

The cost of obtaining a Tax Residency Certificate varies depending on the authority issuing it and the specific requirements of the applicant. Typically, individuals and businesses can expect to pay administrative fees ranging from AED 1,000 to AED 5,000. The exact price can differ based on the emirate and any additional services required.

The validity of the certificate is usually one year, after which it must be renewed. To maintain tax residency, applicants must continue to meet the necessary requirements, such as fulfilling the minimum stay period for individuals or keeping up with business operations in the UAE.

Tax Residency Certificate UAE Cost – Fees for Individuals and Companies

The cost of obtaining a UAE Tax Residency Certificate varies for individuals and companies:

- For Individuals: The typical fee ranges between AED 1,000 to AED 2,000 depending on the emirate and the nature of the application.

- For Companies: The fees can range from AED 2,000 to AED 5,000 or more, depending on the size of the company and the complexity of the application.

Additional service fees may apply if you choose expedited processing or if you require legal assistance from a consultancy like Tulpar Global Taxation.

Validity of Tax Residency Certificate – How Long is the Certificate Valid?

The UAE Tax Residency Certificate is typically valid for one year. After this period, you will need to renew the certificate if you wish to continue benefiting from its advantages, such as avoiding dual taxation or claiming tax exemptions in other jurisdictions.

Renewal Process for a Tax Residency Domicile Certificate: To renew your tax domicile certificate in UAE, you’ll need to reapply with the same process as the initial application. Ensure you submit updated documents and financial statements (for companies) to demonstrate continued residency or business activity in the U.A.E.

Common Mistakes to Avoid When Applying for a Tax Residency Certificate

When applying for a UAE Tax Residency Certificate, applicants often make a few common mistakes that can delay or complicate the process. One frequent mistake is not meeting the minimum stay requirement of 183 – days for individuals or failing to provide proof of a permanent residence in the UAE. Another error is submitting incomplete or inaccurate documentation, such as incorrect financial statements or missing proof of business operations for companies.

Additionally, businesses may overlook the necessity of having a physical presence in United Arab Emirates. Finally, applicants sometimes fail to demonstrate that they are not tax residents of another country, which can result in the rejection of their application. It’s crucial to carefully review the requirements and ensure all documentation is accurate and complete to avoid delays.

Common Mistakes to Avoid When Applying for a TRC

- Incomplete Documents: Missing IDs or financials? Expect delays.

- Ignoring Deadlines: Apply early, late renewals kill benefits.

- DIY Disasters: Tax laws are tricky, consult pros to avoid rejection.

Errors in the Individual Tax Residency Self-Certification Form

A common mistake in the application process is incorrectly filling out the self-certification form. This form requires you to declare that you meet the necessary residency requirements. Be sure to:

- Accurately list the days spent in the U.A.E.

- Avoid leaving any sections blank or providing vague information.

Tulpar Global Taxation can help ensure that all forms are completed correctly, minimizing the chances of errors.

Missing Documents for Tax Residency Certificate Dubai: Missing documents are another common pitfall. If you forget to include proof of address, your Emirates ID, or the required financial statements, your application may be delayed or rejected. Double-check all requirements before submission.

Request Letter for Tax Residency Certificate – How to Draft It Correctly

- You state your intention to apply for tax residency certificate.

- You briefly explain the purpose (e.g., to claim benefits under tax agreements).

- Provide any additional context, such as details about your UAE residence or business activities.

A poorly drafted letter may hinder your application, so it’s essential to get this right. Tulpar Global Taxation provides drafting services to help make sure your request is clear, concise, and in the correct format.

How to Obtain a Tax Residency Certificate in UAE Fast

To obtain a UAE Tax Residency Certificate quickly, it’s important to ensure that all required documentation is prepared and accurate before submitting the application. Start by meeting the eligibility criteria, such as the minimum stay of 183 – days for individuals or proving that your business has a physical presence in the UAE. Gather necessary documents, including proof of residency, employment contracts, and company registration details.

Applying through the relevant government authority or using a professional service can streamline the process and avoid any errors that might cause delays. Additionally, submitting online applications when available can speed up processing times. Ensuring that all documents are complete and meet the specific requirements will help expedite the approval process.

Expedited Application Process for TRC Certificate UAE

If you need the UAE Tax Residency Certificate quickly, expedited services are available. By choosing an expedited process, your application can be processed in a matter of days. However, expedited services come with additional fees, so make sure you’re prepared for the cost.

Securing a TRC doesn’t have to be a maze. Here’s how to get yours fast:

- Determine Eligibility: Individuals need 183+ days of residency; businesses need a UAE trade license.

- Gather Documents: Passport, visa, Emirates ID, financial statements, and tenancy contracts.

- Apply Online: Use the FTA portal or your local tax authority’s website.

- Pay the Fee: Approx. costs range from AED 1,000–2,000 depending on the country.

- Get Your TRC: Processing takes 5–30 days—faster with expert help!

To get a Tax Residency Certificate in the UAE, apply via the FTA portal with your Emirates ID, passport, and proof of residency. It costs AED 1,000–2,000 and takes 5–30 days.

Key Tips for Securing a Tax Residency Certificate UAE Without Delays

To speed up your TRC application, follow these essential tips:

- Ensure All Documents Are in Order: Make sure your documents, such as proof of residency and bank statements, are updated and complete.

- Double-Check Form Accuracy: Fill out the self-certification form carefully to avoid any mistakes that may cause delays.

- Consult Experts: Engage a professional service like Tulpar Global Taxation to ensure your application is submitted correctly and without delay.

- Use the EmaraTax Portal: Submit your application online through the official EmaraTax platform, where you can track your application status and receive updates promptly.

By taking these proactive steps, you’ll be on your way to securing your UAE Tax Residency Certificate without unnecessary hold-ups.

Secure Your UAE Tax Residency Certificate with Confidence

Obtaining Tax Residency Certificate is a crucial step for individuals and businesses aiming to optimize their tax positions. With the right knowledge and guidance, you can streamline the application process and take advantage of the U.A.E favorable tax environment.

If you’re looking for expert advice and support throughout the process, Tulpar Global Taxation is here to help. Our team of specialists ensures that your application is seamless, accurate, and timely. Contact us today and let us guide you through securing your UAE Tax Residency Certificate with confidence.

FAQs:

A Tax Residency Certificate (TRC) is an official document issued by the UAE Federal Tax

Authority (FTA) that proves an individual or company is a tax resident of the UAE. It’s widely

used to benefit from Double Taxation Avoidance Agreements (DTAAs) and to reduce

withholding taxes in other countries. At Tulpar Global Taxation, we help businesses

understand eligibility and secure TRCs smoothly.

Both individuals and corporate entities registered in the UAE including mainland

companies, Free Zone entities, and UAE citizens/residents can apply for a TRC if they meet

the residency criteria set by the UAE FTA. Tulpar Global Taxation guides applicants through

eligibility checks and documentation requirements for all categories.

- A TRC helps UAE businesses:

- Avoid or reduce double taxation

- Claim benefits under over 100+ DTAA treaties

- Support corporate banking and audit requirements

- Facilitate international contracts and tenders

With expert support from Tulpar Global Taxation, companies improve compliance and

unlock tax benefits globally

Key documents typically include:

• Passport copy (individual) or Trade License (company)

• Emirates ID (individual)

• Proof of residency/address

• Financial statements (for companies)

• UAE bank statements

Requirements vary by applicant type. Tulpar Global Taxation provides customized

document checklists to avoid delays.

Processing time varies, but most TRCs are issued within 7–14 business days once the FTA

receives complete documentation. Complex cases may take longer. With Tulpar Global

Taxation, applicants benefit from pre-submission quality checks that help speed up

approval.

A TRC is usually valid for one year from the date of issue. Renewal applications should be

made before expiry to ensure uninterrupted tax benefits. Tulpar Global Taxation’s renewal

service helps maintain compliance year after year.

Yes. While the UAE has no personal income tax, a TRC helps UAE residents prove their tax

domicile status abroad reducing the risk of being taxed twice on foreign income. Tulpar

Global Taxation assists individuals planning overseas investments or income streams.

A TRC is essential for investors to:

- Claim treaty benefits on dividends, interest, and royalties

- Reduce withholding taxes in partner countries

- Improve credibility with international partners and banks

At Tulpar Global Taxation, we align your TRC strategy with global investment goals.

Common pitfalls include:

- Incomplete or inaccurate documentation

- Not meeting minimum residency conditions

- Mismatched financial records

Tulpar Global Taxation conducts thorough reviews and compliance checks to help prevent

rejections and resubmissions.

Tulpar Global Taxation offers end-to-end support including:

- Eligibility assessment

- Document preparation & validation

- Application submission to UAE FTA

- Follow-ups to ensure timely issuance

Our UAE-focused tax experts make the process smooth, accurate, and stress-free for both

businesses and individuals.